Rivian Automotive Inc (NASDAQ:RIVN) shares are trending Tuesday morning as investors digest recent company news and await upcoming earnings.

- RIVN stock is taking a breather. Check out the latest moves here.

What To Know: The EV maker recently agreed to a $250 million settlement to resolve a 2022 investor lawsuit, a move that allows management to focus on future growth initiatives. Additionally, the upcoming mass-market R2 vehicle is central to its strategy. Rivian has confirmed it is on track to begin deliveries of the more affordable midsize SUV in the first half of 2026.

The settlement comes amid a shifting market. Third-quarter data showed strong demand for electric pickups, with Rivian's R1T sales growing 13.1% year-over-year. Unlike rivals GM and Stellantis, Rivian has not offered extended incentives after the federal EV tax credit expired on Sept. 30.

Investors are now looking ahead to the company’s third-quarter earnings report, scheduled for release after the market close on Nov. 4. According to analyst estimates, the company is expected to post a loss of 87 cents per share on revenue of $1.49 billion.

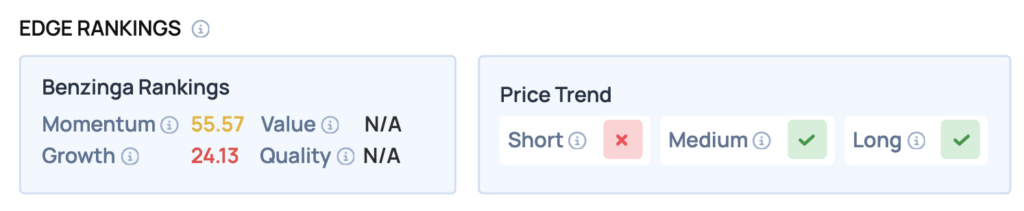

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, Rivian shows a notable weakness in its Growth score, which stands at just 24.13.

RIVN Price Action: Rivian Automotive shares were up 0.64% at $13.46 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Demand For Electric Pickup Trucks Soar In Q3, Except If You’re Tesla

How To Buy RIVN Stock

By now you're likely curious about how to participate in the market for Rivian – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock