Shares of Rivian Automotive Inc (NASDAQ:RIVN) are trading higher Wednesday afternoon, despite a lack of company-specific news for the session. Here’s what investors need to know.

What To Know: Optimism over the past week is largely centered on the upcoming R2 SUV. An analyst from Needham recently reiterated a Buy rating for Rivian, highlighting the potential of the more affordable $50,000 vehicle to significantly expand the company’s market reach.

The report noted Rivian’s strong brand awareness and customer satisfaction as key assets that will help it capture a significant share of the mid-size SUV market and potentially beat 2026 delivery estimates.

Fueling these future production plans, Rivian is set to officially break ground on its $5 billion factory in Georgia on Sept. 16. The new plant, supported by a $1.5 billion state incentive package, is crucial for the manufacturing of the R2 crossover and is expected to begin production in 2028.

These positive developments are helping investors look past recent headwinds. The company is currently facing a revenue shortfall of nearly $100 million after a rollback of federal fuel economy rules froze the market for regulatory credits, a key revenue stream for EV makers. Tariffs are also adding to production costs.

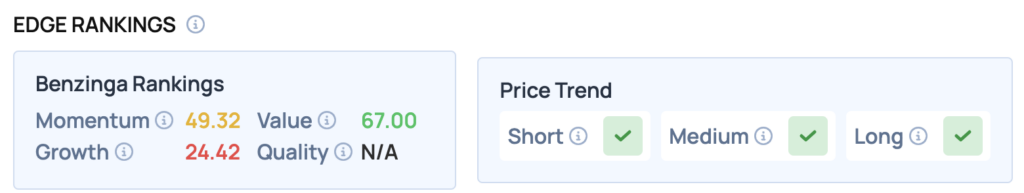

Benzinga Edge Rankings: Underscoring its potential appeal to investors, Rivian currently boasts a strong Value score of 67.00, according to Benzinga Edge stock rankings.

RIVN Price Action: According to data from Benzinga Pro, Rivian shares are trading higher by 7.35% to $14.89 Wednesday afternoon. The stock has a 52-week high of $17.14 and a 52-week low of $9.50.

Read Also: Apple Stock Is Rising Wednesday: Here’s Why

How To Buy RIVN Stock

By now you're likely curious about how to participate in the market for Rivian Automotive – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock