Shares of POET Technologies Inc (NASDAQ:POET) are trading lower Thursday morning after a strong rally earlier in the week. Here’s what investors need to know.

What To Know: The surge was fueled by the announcement of a $75 million private placement with a single institutional investor, the largest single investment in the company’s history. The financing sparked speculation that the company could announce an investment from a big AI name.

The deal involved the issuance of over 13.6 million common shares and an equal number of warrants. Each unit, consisting of one share and one warrant, was priced at $5.50. The warrants are exercisable at $9.78 per share and expire on Oct. 7, 2030.

POET intends to use the net proceeds for corporate development, including potential acquisitions, expanding research and development and accelerating its light source business.

CEO Suresh Venkatesan stated the capital injection, which created a war chest of over $150 million with no significant debt, positions the company to scale its growth in the AI hardware market.

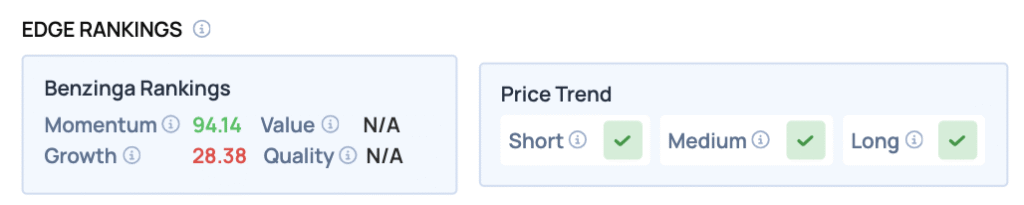

Benzinga Edge Rankings: Reflecting the stock’s recent powerful price movement, Benzinga Edge data shows POET with a very strong Momentum score of 94.14.

POET Price Action: POET Technologies shares were down 7.05% at $8.61 at the time of publication Thursday, according to Benzinga Pro.

Read Also: Silver Hits Record $50, Marks Best Year Since 2010: 5 Miners To Watch

How To Buy POET Stock

By now you're likely curious about how to participate in the market for POET Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock