Shares of Plug Power Inc (NASDAQ:PLUG) are trading slightly lower Wednesday morning in a modest pullback following a 150% rally over the past month. The dip appears to be a consolidation, with no new company-specific catalysts driving the move.

- PLUG is taking a hit from negative sentiment. Stay ahead of the curve here.

What To Know: Plug Power stock surged over the past few trading sessions on a wave of positive developments that eased near-term solvency concerns. Plug secured a $370 million lifeline through a warrant inducement deal, providing immediate capital. The deal includes new warrants that could raise an additional $1.4 billion if fully exercised.

Sentiment was further bolstered by the appointment of a new CEO, Jose Luis Crespo, and a positive analyst note from Susquehanna, which nearly doubled its price target to $3.50.

While the recent financing brought temporary relief, investor focus now shifts to the new leadership’s ability to navigate the path to long-term profitability in the hydrogen sector. The company will be engaging with investors this week at a roadshow in Canada.

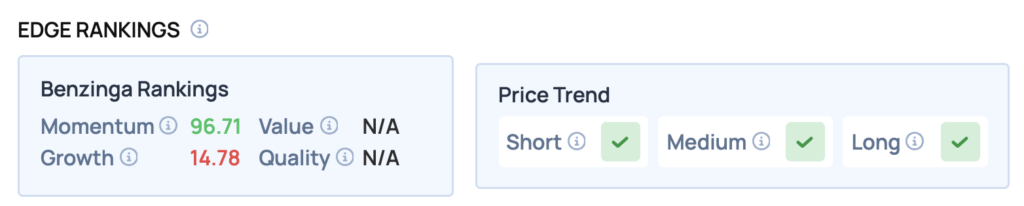

Benzinga Edge Rankings: Reflecting its recent sharp price movement, Plug Power currently holds a very high Momentum score of 96.71, according to Benzinga Edge Rankings.

PLUG Price Action: Plug Power shares were down 4.94% at $3.85 at the time of publication Wednesday, according to Benzinga Pro. The stock is trading near its 52-week high of $4.58.

Plug Power stock is significantly above its 50-day moving average of $2.12, indicating a bullish trend, but it has faced resistance near the intraday high of $4.25. Support appears to be established at the recent low of $3.90, suggesting a potential range for short-term trading.

Read Also: Powell Seals Another Rate Cut—Is This The Spark The Housing Market Needs?

How To Buy PLUG Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Plug Power’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock