Plug Power Inc (NASDAQ:PLUG) shares are trading higher by 33% over the past week, lifted by a favorable macroeconomic shift and growing optimism for the hydrogen sector. The stock’s ascent has coincided with the Global X Hydrogen ETF (NASDAQ:HYDR), of which Plug Power is a major holding, touching a new 52-week high Thursday morning.

What To Know: A key catalyst for the rally is the Federal Reserve’s interest rate cut Wednesday. This monetary easing is particularly beneficial for growth-oriented technology companies like Plug Power. As a leader in the capital-intensive hydrogen fuel cell industry, Plug relies heavily on financing to fund research, development and expansion.

Lower interest rates reduce the cost of borrowing, making it cheaper to finance operations and invest in new projects, potentially easing the path to future profitability. The positive sentiment is further supported by the increasing demand for green energy solutions, highlighted by the power needs of the expanding AI industry.

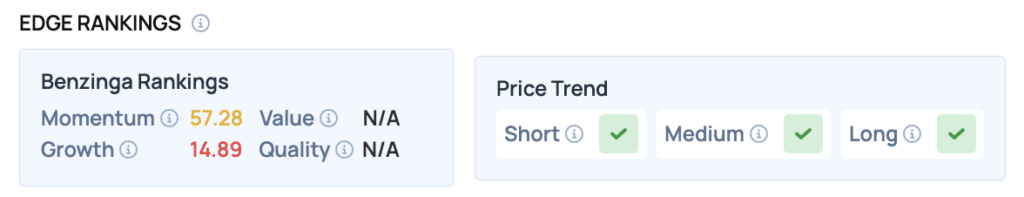

Benzinga Edge Rankings: Underscoring this rally, Benzinga Edge rankings show the stock has a solid momentum score of 57.28 and a positive price trend across short, medium, and long-term outlooks.

Price Action: According to data from Benzinga Pro, PLUG shares are trading higher by 33% to $2.04 over the past week. The stock has a 52-week high of $3.32 and a 52-week low of $0.69.

Read Also: IonQ Stock Is Hitting New Highs Thursday: What’s Going On?

How To Buy PLUG Stock

By now you're likely curious about how to participate in the market for Plug Power – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock