Palo Alto Networks Inc (NASDAQ:PANW) shares are trading marginally higher Wednesday morning as investors potentially see a favorable read-through from Oracle Corp’s blockbuster earnings report. While Oracle missed quarterly estimates, its stock soared over 30% on the back of a stunning forecast for its cloud business.

What To Know: Oracle's executives highlighted an incredible 1,529% growth in multi-cloud database revenue and projected its cloud infrastructure revenue will grow exponentially in the coming years. This signals a massive wave of enterprise spending dedicated to building out cloud and multi-cloud environments.

This trend directly benefits Palo Alto Networks, a global leader in cybersecurity. The company provides essential security platforms, including advanced firewalls and cloud-native solutions, designed to protect the very corporate cloud infrastructure that is fueling Oracle’s explosive growth.

The positive sentiment for PANW stems from the expectation that as companies invest heavily in cloud services, a proportional increase in spending on securing those digital assets will inevitably follow, driving demand for Palo Alto’s products.

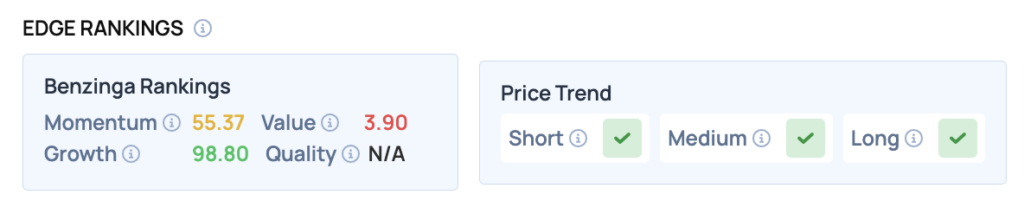

Benzinga Edge Rankings: Underscoring this positive outlook, Benzinga Edge rankings show PANW stock possesses an exceptional Growth score of 98.80.

Price Action: According to data from Benzinga Pro, PANW shares are trading higher by 0.8% to $199.12 Wednesday morning. The stock has a 52-week high of $210.39 and a 52-week low of $144.14.

Read Also: Producer Inflation Tumbles–And Wall Street Sets New Record Highs

How To Buy PANW Stock

By now you're likely curious about how to participate in the market for Palo Alto Networks – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock