Palantir Technologies Inc (NASDAQ:PLTR) shares are trading lower Wednesday afternoon, potentially amid overall market volatility following of today’s Federal Reserve interest rate decision.

What To Know: A string of positive operational updates from Palantir, including a key CMMC Level 2 cybersecurity certification on Wednesday and an expanded U.K. defense partnership last week, are failing to catch investor attention Wednesday.

Despite these positive developments, investor focus appears to have shifted toward mounting competitive pressures and persistent concerns over the company’s high-flying valuation.

Adding to investor unease are increasingly vocal challenges from Salesforce, whose CEO Marc Benioff recently touted a major U.S. Army contract win over Palantir, claiming its Missionforce is a more cost-effective solution. This has intensified the debate around Palantir’s premium pricing.

Furthermore, cautionary comparisons have been drawn between Palantir’s current high-flying valuation and Cisco’s trajectory during the dot-com bubble, raising fears of a potential correction.

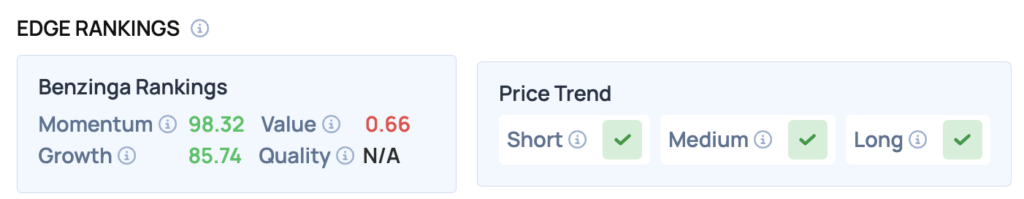

Benzinga Edge Rankings: PLTR’s volatility is captured in its Benzinga Edge rankings, which show an exceptionally strong Momentum score of 98.32 while scoring a deeply bearish 0.66 for Value.

Price Action: According to data from Benzinga Pro, PLTR shares are trading lower by 3.65% to $164.04 Wednesday afternoon. The stock has a 52-week high of $189.46 and a 52-week low of $35.71.

Read Also: What’s Going On With Rocket Lab Stock Wednesday?

How To Buy PLTR Stock

By now you're likely curious about how to participate in the market for Palantir Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

.png?w=600)