Shares of Opendoor Technologies Inc (NASDAQ: OPEN) are pulling back on Friday, experiencing what appears to be profit-taking after a mid-week rally. The stock had surged on a combination of bullish housing data and a new institutional investment.

What To Know: The rally was ignited by a U.S. Census Bureau report showing August new home sales soared 20.5% from the prior month to a seasonally adjusted annual rate of 800,000.

This positive sector news was amplified by a 13G filing that disclosed investment giant Jane Street had acquired a 5.9% stake in the iBuyer, totaling over 44 million shares. This signal of institutional confidence helped propel the stock higher.

Having achieved year-to-date gains exceeding 450% by Thursday’s close, the stock could became a prime candidate for a correction. Investors appear to be capitalizing on the stock’s substantial run-up and locking in profits ahead of the weekend, leading to Friday’s downward pressure on the share price.

Read Also: Better Home & Finance (BETR) Stock Is Soaring Again: ‘This Is No Meme’

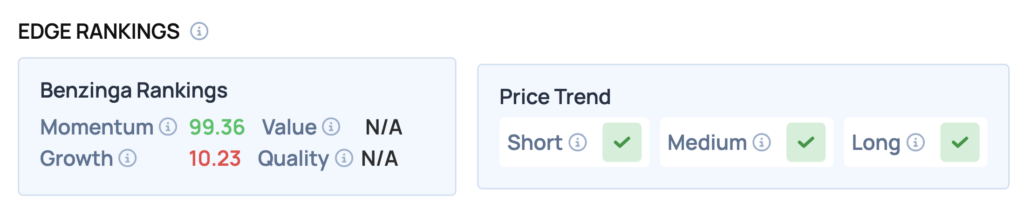

Benzinga Edge Rankings: Reflecting its powerful price movement, Benzinga Edge rankings assign the stock a near-perfect Momentum score of 99.36, while its Growth score sits at just 10.23.

OPEN Price Action: Opendoor Technologies shares were down 4.62% at $8.67 at the time of publication Friday, according to Benzinga Pro. Over the past month, OPEN has gained about 76.0% versus a 2.6% rise in the S&P 500 and is up roughly 431% year-to-date compared to the index’s 12.2% gain. The stock is trading within its 52-week range of $0.50 to $10.87.

Technical Momentum: The stock is significantly above its 50-day moving average of $4.68, indicating a bullish trend over the medium term, but the recent drop suggests potential resistance at the $9 level. Key support is likely to be found near the recent low of $8.36, with the 200-day moving average at $2.01 providing a long-term support level

How To Buy OPEN Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Opendoor Technologies’ case, it is in the Real Estate sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock