Opendoor Technologies Inc (NASDAQ:OPEN) shares are rallying Monday, continuing a turbulent but bullish trend from last week. The stock is trading higher Monday, building on a five-day gain of over 50% that saw its price climb from around $6 to over $9 per share.

What To Know: The recent volatility follows major leadership changes. The stock initially soared last week on news that former Shopify COO Kaz Nejatian would take over as CEO, with co-founders Keith Rabois and Eric Wu rejoining the board. This move, hailed as a return to “FounderMode,” sparked significant investor optimism.

However, the rally was briefly derailed Friday after Rabois stated on CNBC that the company was “completely bloated” and required a sweeping overhaul. Despite these comments causing a temporary pullback, investor sentiment has rebounded.

Bulls appear to be focusing on the long-term potential of the aggressive new leadership, with some analysts, like Eric Jackson, suggesting Opendoor could become the “Amazon of housing” under its revitalized management team.

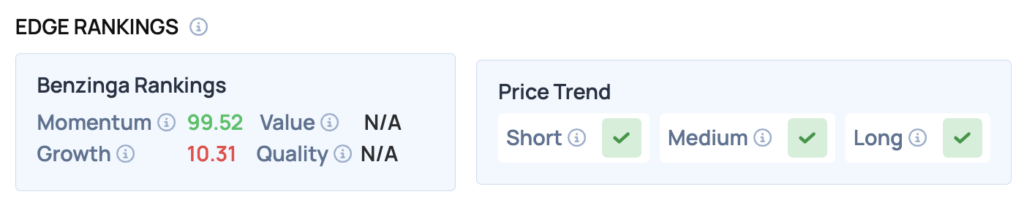

Benzinga Edge Rankings: Underscoring the stock’s powerful rally, Benzinga Edge rankings give Opendoor a near-perfect Momentum score of 99.52.

Price Action: According to data from Benzinga Pro, OPEN shares are trading higher by 8.88% to $9.87 Monday morning. The stock has a 52-week high of $10.70 and a 52-week low of $0.51.

Read Also: Jim Cramer: Ring The Register On This Real Estate ‘Meme’ Stock

How To Buy OPEN Stock

By now you're likely curious about how to participate in the market for Opendoor Technologies – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Opendoor Technologies, which is trading at $9.87 as of publishing time, $100 would buy you 10.13 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock