Shares of nuclear startup Oklo Inc (NYSE:OKLO) are trading marginally lower Thursday afternoon as investors digest a week of conflicting catalysts for the volatile stock. The slight decline follows a significant sector-wide rally earlier in the week.

- OKLO is trading near recent highs. Get the latest updates here.

What To Know: On Tuesday, nuclear stocks surged after news broke of an $80 billion deal between Cameco Corp and the Trump administration to construct new nuclear reactors.

The announcement ignited broad sector enthusiasm, lifting shares of developers like Oklo. However, this came just a day after shares fell amid a re-evaluation of its fundamental risks.

Concerns persist regarding the company's lofty valuation, pre-revenue status and reliance on historically challenging reactor technology. While Oklo’s partnerships for powering AI and a Pentagon microreactor project fuel investor interest, the company faces significant operational hurdles.

Investors are now looking ahead to Oklo’s quarterly earnings report on Nov. 11, where analysts are forecasting a loss of 13 cents per share.

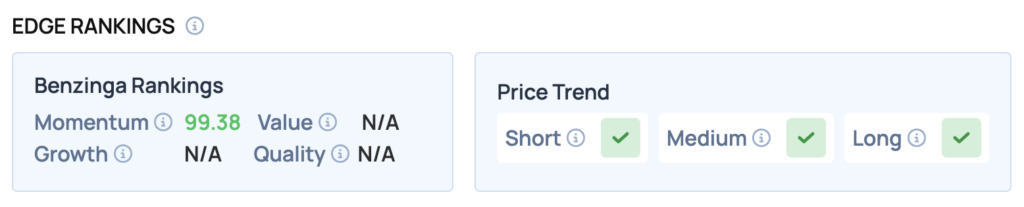

Benzinga Edge Rankings: Reflecting its recent volatile trading, Benzinga Edge Rankings assign Oklo an exceptionally high Momentum score of 99.38.

OKLO Price Action: Oklo shares were down 2.22% at $140.23 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Powell Taps The Brakes In The Fog, But Traders Keep Hitting The Gas

How To Buy OKLO Stock

By now you're likely curious about how to participate in the market for Oklo – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock