Shares of advanced nuclear energy firm Oklo Inc (NYSE:OKLO) are trading higher Thursday. The surge follows a bullish analyst update this week and recently announced strategic partnerships aimed at powering the energy-intensive artificial intelligence sector. Here’s what investors need to know.

What To Know: This week, Bank of America initiated coverage with a Buy rating and a $92 price target, citing Oklo as “well positioned to meet the rising energy needs of AI.” Oklo has been actively capitalizing on this trend, with a pipeline of more than 14 gigawatts in memorandums of understanding.

The positive momentum follows a recent financial report on Aug. 11, where Oklo announced a wider-than-expected second-quarter loss of 18 cents per share. However, investors appear to be focusing on the company’s long-term growth prospects, with the stock up over 250% on a year-to-date basis.

Adding to the optimism, Oklo recently announced a partnership with automation leader ABB to develop a digital monitoring room for its Aurora powerhouses. This collaboration, along with its selection for the U.S. Department of Energy’s Reactor Pilot Program, has helped the stock gain roughly 9% in the month of August.

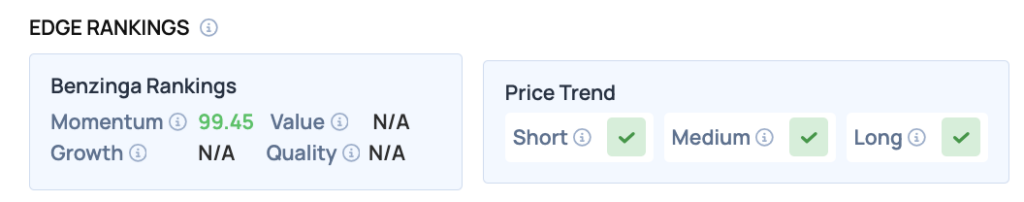

Price Action: According to data from Benzinga Pro, Oklo shares are trading higher by 6.6% to $78.08 on Thursday. The stock has a 52-week high of $85.35 and a 52-week low of $5.35.

Read Also: Snowflake Stock Is On Fire Thursday: Here’s Why

How To Buy OKLO Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Oklo’s case, it is in the Utilities sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock