Oklo Inc (NYSE:OKLO) shares are trading flat Thursday morning, pausing a 35% correction over the past month. While the nuclear startup this week secured a key partnership with Siemens Energy, the market is primarily digesting Nvidia's blockbuster third-quarter earnings report.

- OKLO shares are climbing with conviction. Follow the breaking news here.

What To Know: Nvidia reported $57.01 billion in revenue, beating estimates, driven by a massive 56% year-over-year jump in Data Center revenue to $51.2 billion. For Oklo investors, this is a vital proxy signal: the AI infrastructure boom is accelerating, not slowing.

The market in 2025 has been effectively pricing Oklo as a derivative of the AI trade. Advanced AI training and inference require immense amounts of electricity, creating a supply bottleneck that intermittent renewables (solar/wind) cannot solve alone.

As Nvidia's customers, hyperscalers, expand data center capacity to accommodate next-gen chips, the demand for 24/7 baseload power becomes critical.

Oklo's “Aurora” fission powerhouses are pitched as the scalable solution to this energy deficit. Despite Oklo being pre-revenue and recently missing earnings estimates, Nvidia’s guidance confirms that the capital expenditure cycle for AI is robust.

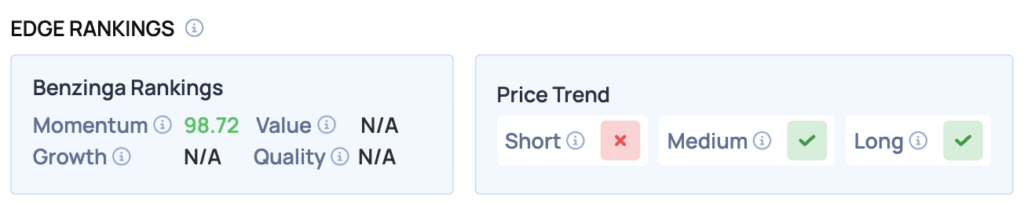

Benzinga Edge Rankings: Benzinga Edge data underscores this intense market activity, assigning Oklo an exceptionally high Momentum score of 98.72.

OKLO Price Action: Oklo shares were up 0.17% at $102.90 early Thursday before trading flat at the time of publication, according to Benzinga Pro data.

Read Also: September Jobs Spike Threatens Fed Cut, But Wall Street Still Jumps

How To Buy OKLO Stock

By now you're likely curious about how to participate in the market for Oklo – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock