Nio Inc – ADR (NYSE:NIO) shares are trading lower Thursday afternoon amid a mix of recent company news. Freedom Capital Markets analyst Dmitriy Pozdnyakov earlier downgraded NIO from Buy to Hold, but raised the price target from $4.9 to $6.5. Here’s what investors need to know.

What To Know: The company on Tuesday reported a second-quarter loss of 25 cents per share, missing analyst estimates of a 20-cent loss, but revenues of $2.65 billion exceeded the consensus forecast of $2.5 billion. Nio’s CEO, William Li, attributed the strong revenue to robust demand for the new ONVO and Firefly models, which drove record August deliveries of over 31,300 vehicles.

The stock’s decline Thursday comes amid warnings from Li about a potential slowdown in the Chinese EV market. Li noted that the government’s vehicle purchase tax relief is expected to taper off in the first quarter of 2026, which could impact sales.

Despite this, Nio remains focused on its cost-saving measures, including the development of an in-house smart driving chip, and is continuing its global expansion efforts into new markets like Singapore, Uzbekistan and Costa Rica.

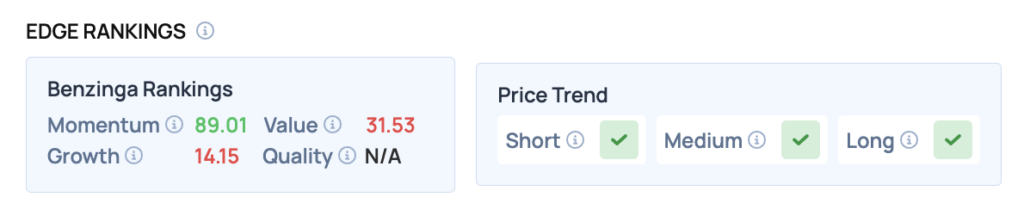

Benzinga Edge Rankings: According to Benzinga Edge stock rankings, the company has a strong momentum score of 89.01, despite low scores for value and growth.

Price Action: According to data from Benzinga Pro, NIO shares are trading lower by 2.59% to $6.157 Thursday afternoon. The stock has a 52-week high of $7.71 and a 52-week low of $3.02.

Read Also: C3.AI Stock Is Tumbling Thursday: What’s Going On?

How To Buy NIO Stock

By now you're likely curious about how to participate in the market for NIO – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock