Nike Inc (NYSE:NKE) shares are falling Friday in sympathy with Lululemon Athletica Inc (NASDAQ:LULU), as investors grew concerned that escalating U.S. tariffs on imported goods will pressure margins across the athletic apparel sector.

What To Know: Lululemon stock tumbled 18% after the company slashed guidance, citing the removal of the de minimis exemption, which previously allowed duty-free imports under $800, and higher tariffs on goods from hubs such as China and Vietnam.

The policy change, effective August 29, is expected to erode Lululemon's gross profit by about $240 million and compress margins by 300 basis points in 2025, well below prior forecasts. Management acknowledged higher sourcing costs would weigh on earnings despite strong second-quarter results, while Wall Street analysts responded with a wave of downgrades.

For Nike, which also sources heavily from Asia, the selloff reflected fears that similar tariff pressures could impact its margins and consumer pricing strategy. The broad pullback underscores investor unease that new trade headwinds may ripple through the athletic wear industry, squeezing profitability even for market leaders.

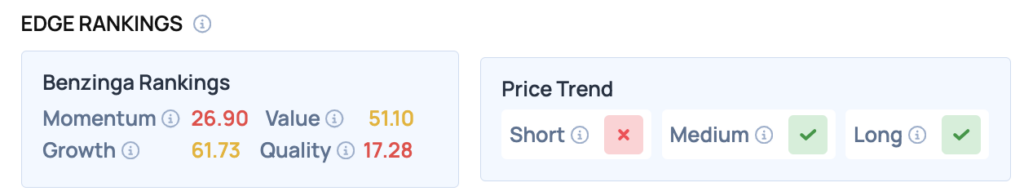

Benzinga Edge Rankings: Benzinga Edge ranks Nike with a weak Quality score of just 17.28, highlighting margin risks that could weigh on performance.

Price Action: According to data from Benzinga Pro, NKE shares are trading lower by 2.11% to $73.77 Friday. The stock has a 52-week high of $90.62 and a 52-week low of $52.28.

Read Also: Traders Hit The Buy Button On These 10 Stocks After Weak Jobs Report

How To Buy NKE Stock

By now you're likely curious about how to participate in the market for Nike – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock