Meta Platforms Inc (NASDAQ:META) shares are traded lower on Wednesday as the company’s massive spending on artificial intelligence comes into sharper focus. Here’s what investors need to know.

Check out how META stock is doing here.

What To Know: The social media giant’s investment in its “Hyperion” AI data center in Louisiana has reportedly surged to $50 billion, a fivefold increase from the initial $10 billion estimate.

This massive expenditure, revealed by President Donald Trump, is backed by $29 billion in financing and has sparked concerns among investors and regulators regarding its escalating costs and substantial energy requirements.

Furthering its hardware ambitions, Meta is also preparing to launch its “Hypernova” smart glasses. According to TF International Securities analyst Ming-Chi Kuo, the $800 device is considered an “experimental product” with a limited initial production run of 150,000 to 200,000 units expected over two years, beginning in the third quarter of 2025.

While these long-term AI and augmented reality initiatives are central to Meta’s strategy, the scale of the investments is creating near-term headwinds.

The ballooning budget for the Hyperion project, coupled with the experimental nature of new hardware, could be weighing on investor sentiment on Wednesday, reflecting the financial risks associated with the company’s aggressive push in AI.

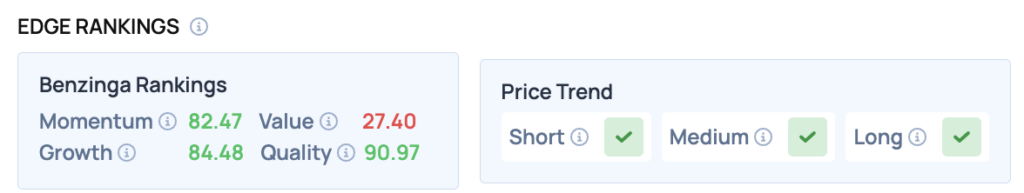

META Price Action: According to data from Benzinga Pro, Meta Platforms shares closed Wednesday down 0.89% to $747.38. The stock has a 52-week high of $796.25 and a 52-week low of $479.80.

Read Also: MongoDB Stock Is Soaring Wednesday: Here’s Why

How To Buy META Stock

Besides going to a brokerage platform to purchase a share — or fractional share — of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For Meta Platforms, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock