Shares of Lululemon Athletica Inc (NASDAQ:LULU) are trading near their 52-week low during Monday’s session after the company last week slashed its full-year forecast and warned of significant margin pressure from new U.S. tariffs. Here’s what investors need to know.

What To Know: The athletic apparel maker reported mixed second-quarter results, beating earnings estimates with an EPS of $3.10 but slightly missing revenue expectations. However, investor focus quickly shifted to the company’s soft guidance and external headwinds. Lululemon cut its full-year earnings per share forecast to a range of $12.77-$12.97, down from a previous estimate of $14.58-$14.78.

Management cited considerable impact from the recent removal of the “de minimis” exemption, which allowed many e-commerce orders to enter the U.S. duty-free. The company now anticipates a $240 million hit to gross profit, projecting a gross margin decrease of up to 300 basis points for 2025.

Adding to concerns was a notable slowdown in its domestic market, with disappointing same-store sales in North America. In response to the bleak outlook, a wave of Wall Street analysts, including those from BofA Securities, JPMorgan and Telsey Advisory Group, downgraded the stock and cut their price targets, signaling growing concerns over profitability.

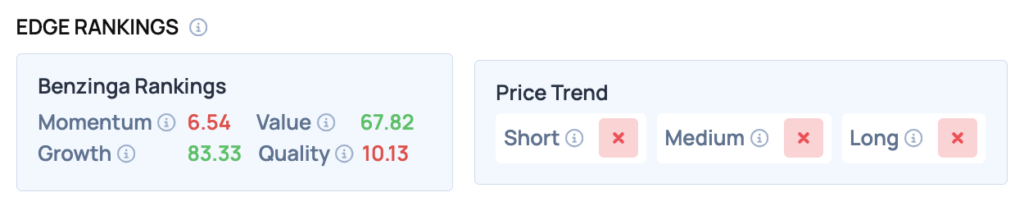

Benzinga Edge Rankings: Despite the stock’s poor momentum score of just 6.54, Benzinga Edge rankings highlight its strong growth and value scores of 83.33 and 67.82, respectively.

Price Action: According to data from Benzinga Pro, LULU shares are trading lower by 0.5% to $166.98 Monday morning. The stock has a 52-week high of $423.32 and a 52-week low of $163.95.

How To Buy LULU Stock

By now you're likely curious about how to participate in the market for Lululemon Athletica – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock