Lucid Group Inc (NASDAQ:LCID) shares closed flat Tuesday. The muted session comes after a period of significant volatility for the electric vehicle maker, which has been recovering from a 52-week low of $15.25 seen earlier in September. Here’s what investors need to know.

See how LCID stock is doing here.

What To Know: The stock’s recent ascent has been fueled by a rebound from a 1-for-10 reverse stock split and a vote of confidence from Wall Street, with some analysts raising their price targets.

Adding to the positive sentiment is a recently announced deal to deploy over 20,000 of its vehicles as robotaxis for Uber in Saudi Arabia, a significant step into the autonomous ride-hailing market.

However, investor enthusiasm appears to be tempered by lingering concerns. The company’s lowered 2025 production forecast, reduced to a range of 18,000 to 20,000 vehicles, continues to weigh on sentiment.

The flat trading on Tuesday suggests investors are cautiously weighing the promising long-term potential against the more immediate production challenges, leading to a pause in the stock’s recent upward trajectory.

Technical Momentum: LCID closed Tuesday at $22.54, slightly below its 50-day moving average of $22.60, indicating a neutral trend. The stock has a recent high of $23.94, suggesting potential resistance at this level, while the low of $22.23 provides a nearby support point. The overall trend appears to be consolidating, with price action hovering around key moving averages.

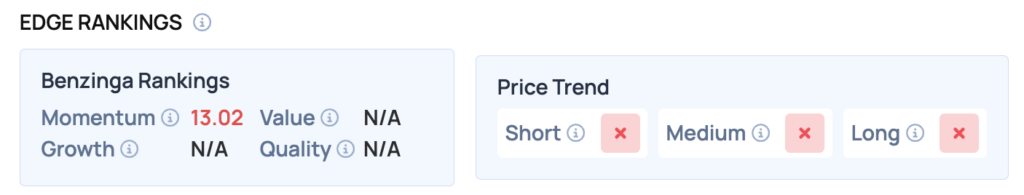

Benzinga Edge Rankings: According to Benzinga Edge rankings, LCID currently has a Momentum score of 13.02, while its short, medium and long-term price trends are all negative.

Read Also: Plug Power Stock Is Sliding Tuesday: What’s Going On?

How To Buy LCID Stock

By now, you're likely curious about how to participate in the market for Lucid Group — be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Image: Shutterstock