Shares of Lucid Group Inc (NASDAQ:LCID) are falling Tuesday as the electric vehicle maker begins trading on a split-adjusted basis. The company's 1-for-10 reverse stock split, which was approved by stockholders on August 18, became effective after the market closed on Friday.

What To Know: The action consolidates every ten pre-split shares into one new share, a move designed to lift the company's per-share price. As a result, the number of outstanding shares has been reduced from approximately 3.07 billion to about 307.3 million, with total authorized shares cut from 15 billion to 1.5 billion.

This move comes at a challenging time for Lucid. The stock has dropped over 30% year-to-date, amplified by a recent second-quarter earnings report that failed to meet analyst expectations.

Further dampening sentiment, the company recently lowered its 2025 production guidance, now targeting just 18,000 to 20,000 vehicles for the year.

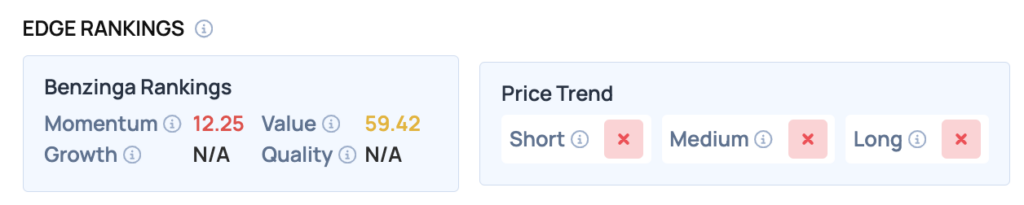

Benzinga Edge Rankings: Reflecting Tuesday’s downturn, Benzinga’s Edge stock rankings show LCID has a very weak Momentum score of 12.25.

Price Action: According to data from Benzinga Pro, LCID shares are trading lower by 4.4% to $18.93 Tuesday morning. The stock has a 52-week high of $42.85 and a 52-week low of $17.36.

How To Buy LCID Stock

By now you're likely curious about how to participate in the market for Lucid Group – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock