Shares of electric vehicle maker Lucid Group Inc (NASDAQ:LCID) are falling Friday afternoon as the company prepares to execute its planned reverse stock split after the closing bell.

What To Know: The luxury EV maker is set to enact a 1-for-10 reverse stock split after the market closes today, a move approved by stockholders on August 18. The stock will begin trading on a split-adjusted basis on Tuesday.

This action is designed to lift the company’s share price by consolidating every ten shares of common stock into one. The maneuver will decrease the number of outstanding shares from approximately 3.07 billion to 307.3 million. In a concurrent move, the total number of authorized shares will be reduced from 15 billion to 1.5 billion.

The reverse split comes at a challenging time for Lucid. The company’s stock has seen a roughly 34% decline year-to-date, a slide exacerbated by a recent second-quarter earnings report that failed to meet analyst expectations.

Compounding these difficulties, Lucid recently adjusted its 2025 production guidance downwards, now anticipating a range of 18,000 to 20,000 vehicles.

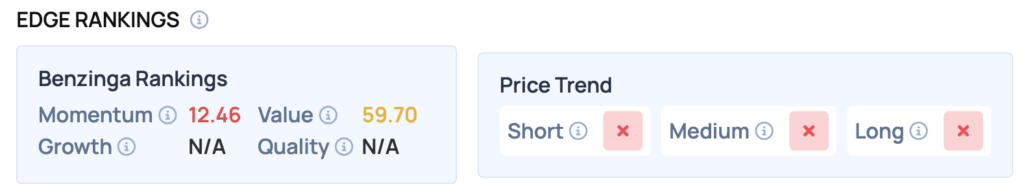

Benzinga Edge Rankings: Reflecting the stock’s recent struggles, Benzinga Edge proprietary rankings show Lucid with a weak Momentum score of just 12.46.

Price Action: According to data from Benzinga Pro, LCID shares are trading lower by 4.35% to $1.98 Friday afternoon. The stock has a 52-week high of $4.29 and a 52-week low of $1.93.

Read Also: China Doesn’t Need Nvidia Anymore: Alibaba’s New Chip Is A Challenge To Washington

How To Buy LCID Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Lucid Group’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock