GameStop Corp (NYSE:GME) shares are trading flat Wednesday afternoon as the stock consolidates following a turbulent October fueled by political memes, regulatory filings and renewed retail interest. Here’s what investors need to know.

- GME is trading near recent lows. Watch the momentum here.

What To Know: The recent volatility was largely sparked by a viral White House social media interaction depicting President Donald Trump as Halo's Master Chief, amplifying GameStop's “end of console wars” campaign.

This sentiment-driven rally coincided with broader “meme stock” momentum spillover from Beyond Meat Inc‘s (NASDAQ:BYND) viral resurgence in October, temporarily overshadowing fundamental concerns.

However, headwinds remain. Selling pressure emerged earlier in the month after the company filed a prospectus for a potential stock offering, raising fears of shareholder dilution.

Institutional skepticism also persists. Hedge fund billionaire Steven Cohen's Point72 Asset Management recently increased its put options by 196%, signaling a strong bet against the rally's longevity.

With the hype settling, investors are pivoting to fundamentals. GameStop is slated to report earnings on Dec. 9, with analysts projecting an EPS of 18 cents and revenue of $987.28 million. The market now waits to see if the console war truce translates into tangible third-quarter growth.

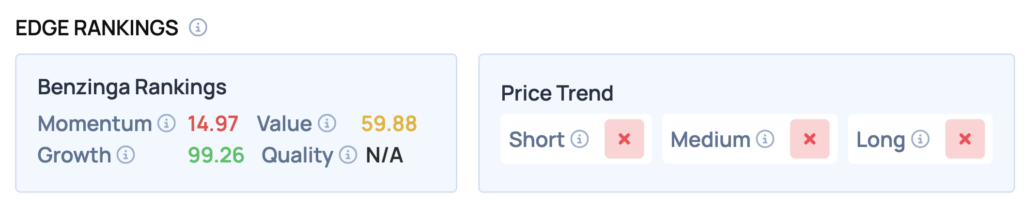

Benzinga Edge Rankings: Benzinga Edge data highlights a stark divergence between price action and potential, assigning GameStop a near-perfect Growth score of 99.26 even as short, medium and long-term price trends remain negative.

GME Price Action: GameStop shares were down 0.37% at $21.36 on Wednesday. The stock is near its 52-week low of $20.73, according to Benzinga Pro data.

Read Also: Why BigBear.ai (BBAI) Stock Soared At The Open Today

How To Buy GME Stock

By now you're likely curious about how to participate in the market for GameStop – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of GameStop, which is trading at $21.37 as of publishing time, $100 would buy you 4.68 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock