Galaxy Digital Inc (NASDAQ:GLXY) shares are trading higher Thursday. The company has made recent strategic announcements that strengthen its institutional footprint in Asia and develop new pathways for digital securities.

What To Know: On Wednesday, the firm announced its GK8 subsidiary will provide custody technology for BDACS, a South Korean regulated institutional digital asset custodian. The partnership will integrate Galaxy’s full suite of services, including staking and tokenization, into the Korean market, signaling a international expansion for its institutional arm.

This news follows last week's announcement of a partnership with Superstate to tokenize Galaxy’s own shares on the Solana (CRYPTO: SOL) blockchain. This move marks the first time a publicly traded U.S. company has enabled its equity to be held directly on a major blockchain.

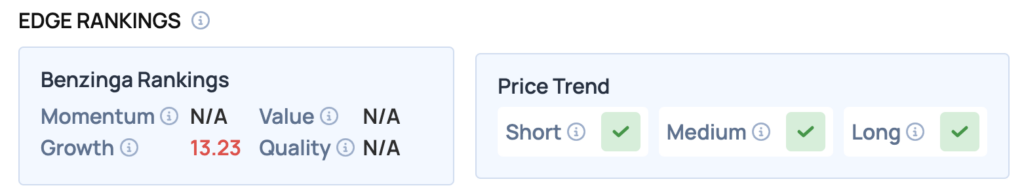

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock shows a positive price trend across short, medium, and long-term outlooks, complemented by a growth score of 13.23.

Price Action: According to data from Benzinga Pro, GLXY shares are trading higher by 10.39% to $28.79 Thursday. The stock has a 52-week high of $33.16 and a 52-week low of $17.40.

Read Also: Ethereum Consolidates Below $4,500: Is A New All-Time High Run Coming Soon?

How To Buy GLXY Stock

By now you're likely curious about how to participate in the market for Galaxy Digital – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Galaxy Digital, which is trading at $28.79 as of publishing time, $100 would buy you 3.47 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock