BigBear.ai Holdings Inc (NYSE:BBAI) shares are trading marginally higher Monday afternoon as investors look toward the company’s upcoming earnings report following a series of positive contract announcements.

- BBAI stock is moving in positive territory. Get the scoop here.

What To Know: Last week, the company’s stock rallied after announcing a new deployment of its “veriScan” biometric platform with U.S. Customs and Border Protection at Chicago O’Hare International Airport.

BigBear.ai reported the AI-powered system reduces passenger processing times from 60 seconds to just 10. This news followed a strategic partnership announced earlier in the month to develop new AI-enabled edge hardware for national security operations.

Investors are now focused on the company’s third-quarter 2025 earnings report, scheduled for after the market closes on Nov. 10th. Wall Street estimates project quarterly revenue of $33.31 million and a loss per share of 7 cents. The stock has gained over 70% year-to-date, and the upcoming report will be critical in sustaining that momentum.

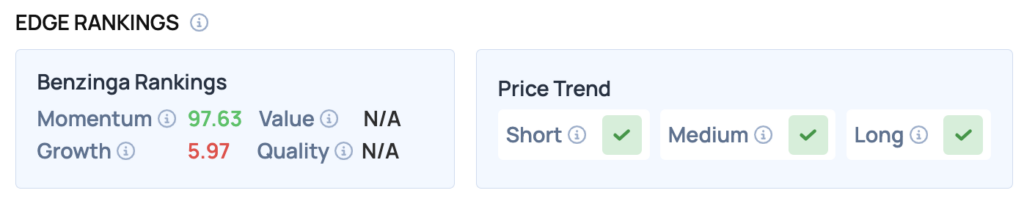

Benzinga Edge Rankings: Reflecting its recent strength, Benzinga Edge stock rankings show BBAI with an exceptionally high Momentum score of 97.63.

BBAI Price Action: BigBear.ai shares were up 1% at $7.12 at the time of publication on Monday, according to Benzinga Pro data.

Read Also: Tech Stocks Rally, Gold Tumbles On US-China Trade Progress: What’s Moving Markets Monday?

How To Buy BBAI Stock

By now you're likely curious about how to participate in the market for BigBear.ai – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock