American Battery Technology Co (NASDAQ:ABAT) shares are trading lower Tuesday afternoon, joining a broader downturn among battery-related stocks. Here’s what investors need to know.

- ABAT is among today’s weakest performers. Get the inside scoop here.

What To Know: The sell-off follows reports from Monday that the U.S. Department of Energy has rescinded over $700 million in grants for battery and manufacturing projects, including a significant $115 million award previously allocated to ABAT.

The recent termination of a federal grant has created uncertainty for the company’s future growth and profitability, which is why the stock is falling Tuesday. The funding was intended for the construction of a commercial-scale lithium hydroxide production facility in Nevada, a key project for strengthening the domestic electric vehicle battery supply chain.

While American Battery Technology has formally appealed the decision and stated its commitment to advancing the project, the loss of government funding has shaken investor confidence.

The company noted it has raised over $52 million from public markets this year and secured a letter of interest for up to $900 million in potential financing from the U.S. Export-Import Bank.

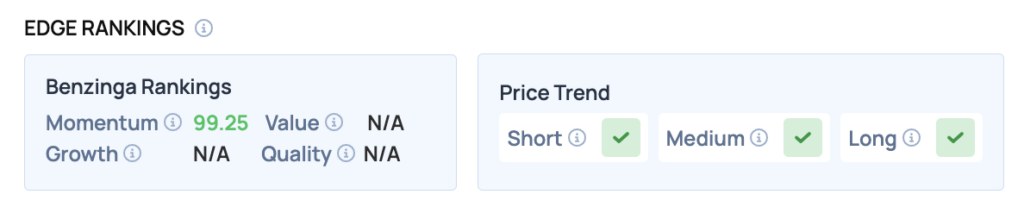

Benzinga Edge Rankings: Despite the recent price drop, Benzinga Edge rankings show the stock has an exceptionally high Momentum score of 99.25.

ABAT Price Action: American Battery Tech shares were down 9.08% at $6.11 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Gold Sinks 5% On Worst Day In 5 Years, Dow Jones Hits Record Highs: What’s Moving Markets Tuesday?

How To Buy ABAT Stock

By now you're likely curious about how to participate in the market for American Battery – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock