Amazon.com Inc (NASDAQ:AMZN) shares are trading slightly lower Wednesday morning as investors process a pair of workforce updates. Here’s what investors need to know.

What To Know: Reports surfaced that Amazon is preparing to lay off up to 15% of its human resources division, with more cuts expected as it ramps up a planned $100 billion investment in artificial intelligence.

The news comes in stark contrast to the company’s recent announcement to hire 250,000 seasonal workers for the holiday rush, signaling strong confidence in consumer spending. The stock was down Tuesday amid broader market pressure from renewed U.S.-China trade tensions and is now down approximately 4.5% over the past week.

Despite the mixed signals, Wall Street sentiment remains positive. Goldman Sachs recently reiterated a Buy rating with a price target of $275. Investors are now looking toward Amazon’s upcoming earnings report on Oct. 30 for further clarity, where analysts forecast revenues of approximately $177.7 billion and earnings per share of $1.56.

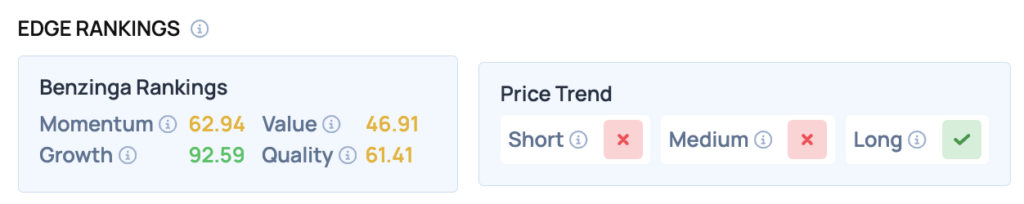

Benzinga Edge Rankings: Supporting the positive long-term outlook, Benzinga Edge stock rankings highlight an exceptional Growth score of 92.59 for the company.

AMZN Price Action: Amazon shares were down 0.49% at $215.37 at the time of publication on Wednesday, according to data from Benzinga Pro. The stock is trading within its 52-week range of $161.38 to $242.52.

Currently, the stock is experiencing a year-to-date decline of 1.7%. The Relative Strength Index (RSI) is at 42.31, indicating a neutral position, suggesting that the stock is neither overbought nor oversold at this time.

Read Also: Powell Seals Another Rate Cut—Is This The Spark The Housing Market Needs?

How To Buy AMZN Stock

By now you're likely curious about how to participate in the market for Amazon – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock