Shares of BigBear.ai Holdings Inc (NYSE:BBAI) are trading lower Tuesday morning, caught in a downdraft affecting the broader AI sector. The move is potentially in sympathy with sector leader Palantir Technologies Inc, which is selling off despite posting strong third-quarter results after Monday’s close.

- BBAI stock is showing notable weakness. Review the technical setup here.

What To Know: Despite Palantir reporting earnings and revenue that beat estimates, fueled by a 121% surge in U.S. commercial revenue, the stock is trading lower as investors potentially take profits amid concerns over its lofty valuation.

Adding to the sector’s bearish sentiment, a regulatory filing revealed Monday that Michael Burry’s Scion Asset Management has taken a massive bearish position against Palantir, purchasing five million put options.

The pullback for BBAI occurs despite recent positive company-specific news, including a new deployment of its veriScan biometric platform with U.S. Customs and Border Protection at Chicago O’Hare.

Investors are now turning their attention to BBAI’s own third-quarter earnings, set for release on Nov. 10, after the market closes. Wall Street estimates project a quarterly loss of 7 cents per share on revenue of $31.54 million. In August, analysts at HC Wainwright & Co. maintained a Buy rating on the stock while lowering their price target from $9 to $8.

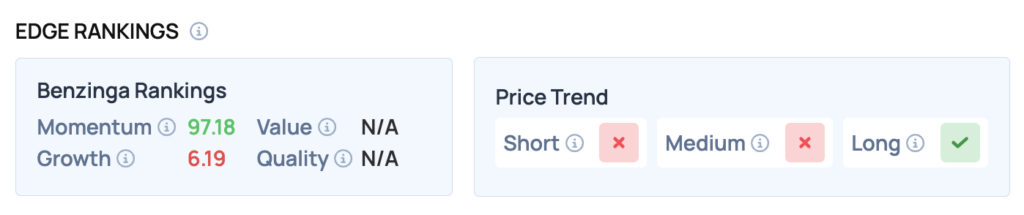

Benzinga Edge Rankings: According to Benzinga Edge Rankings, BBAI exhibits extremely high momentum with a score of 97.18, offset by a weak Growth score of 6.19.

BBAI Price Action: BigBear.ai shares were down 3.1% at $6.10 at the time of publication on Tuesday, according to Benzinga Pro data.

Read Also: Pfizer’s Core Drugs Offset COVID Revenue Drop, Lifts 2025 Profit Outlook Despite Tariffs

How To Buy BBAI Stock

By now you're likely curious about how to participate in the market for BigBear.ai – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of BigBear.ai, which is trading at $6.10 as of publishing time, $100 would buy you 16.39 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock