Rachel Reeves has announced an extension to the freeze on income tax thresholds at today’s Budget, meaning more earners will be soon be made to pay extra tax by “stealth”.

Originally set to be frozen until 2028, the chancellor has opted to extend the freeze for three more years, the Office for Budget Responsibility’s (OBR) fiscal outlook has revealed.

The tax-free personal allowance was first frozen at £12,570 by the previous Conservative government from 2022. Freezing tax thresholds can create what economists call “fiscal drag” – more people are pulled into higher tax brackets as average earnings increase, but the thresholds stay the same.

Both the personal allowance and National Insurance contribution threshold are frozen and will now remain so until 2030/31. The measure will raise £8bn for the treasury in 2029/30, the OBR says.

Here we tell you all you need to know about the changes:

How will the extension affect me?

More workers will begin paying higher rates of tax than they otherwise would have following the change.

It will mean 780,000 more basic-rate, 920,000 more higher-rate, and 4,000 more additional-rate taxpayers by 2029/30 than was forecasted by the OBR in March, the spending watchdog finds.

Basic-rate employees will pay £140 in extra tax each year from April 2028. However, one million-plus earners whose income is above £125,140 – and so already pay the top rate of income tax – will not be affected.

What is income tax?

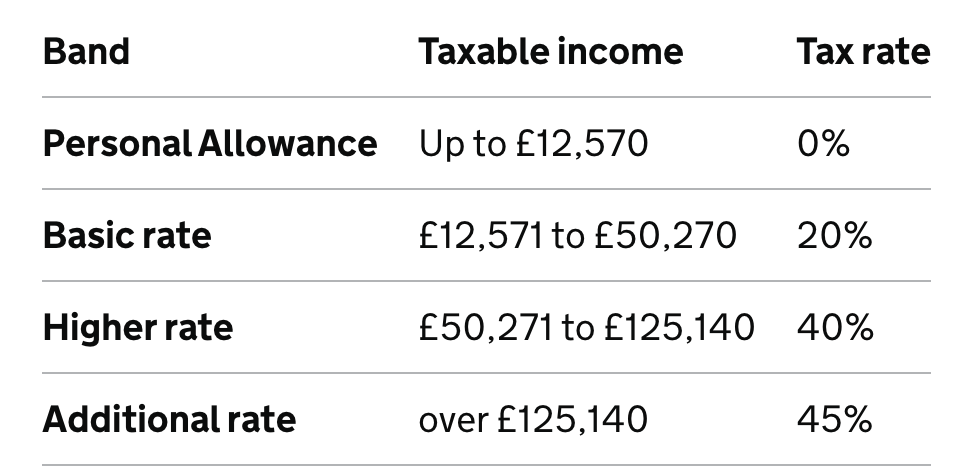

Income tax is a tax paid on income, though not all types of income can be taxed. How much income tax a person pays is based on how much they earn above their personal allowance and how much of their income falls within each tax band.

The standard personal allowance has been £12,570 since 2021. This means that earners do not pay tax on the first £12,570 of their earnings in a financial year. The rate of tax then increases depending on how much they earn.

What are the thresholds and income tax bands?

These bands mean that 20 per cent tax is paid on earnings between £12,571 and £50,270. Earnings between £50,271 and £125,140 are subject to a higher rate of 40 per cent tax.

People who earn in excess of £100,000 start losing the £12,570 personal allowance. This goes down by £1 for every £2 earned above £100,000. The personal allowance does not exist for those earning above £125,140. There is also an additional rate of 45 per cent income tax on all earnings above that.

These rates apply in England, Wales and Northern Ireland, but different rates apply in Scotland.

What is the ‘stealth’ tax rise?

Since 2021, the income tax personal allowance has been frozen at £12,570. This is the amount that can be paid before income tax deductions begin. The measure has been criticised as a way for the Treasury to boost revenue from income tax without increasing its rates.

Rather than increasing with inflation or average earnings as in previous years, this allowance, and all rates, will remain frozen until at least 2028, unless Ms Reeves chooses to change this.

The basic rate of 20 per cent is then paid on any earnings between £12,571 and £50,270, the higher rate of 40 per cent on earnings between £50,271 and £125,140, and the additional rate of 45 per cent on earnings over £125,141.

The effect of this is what economists call “fiscal drag”, where more people are pulled into higher tax brackets as average earnings increase, but the thresholds stay the same.

The respected Institute for Fiscal Studies says these freezes will reduce household incomes by an average of £1,250 by 2025-26. Analysts also point out that the measure will take more from workers’ pockets than they saved with recent tax drops such as the cuts to national insurance.

A recent report from the think tank explains that “the impact of threshold freezes has already been substantial.”

“Freezes to the thresholds at which the basic and higher rates of income tax begin to apply are alone expected to raise £39 billion a year in 2029–30 (roughly similar to the amount of revenue that would be raised by increasing all rates of income tax by 3.5 percentage points).”

Tax calculator: See how Rachel Reeves’ Budget will affect you

Budget 2025: Two-child benefit cap scrapped – here’s what that will mean for parents

From mansion tax to cash ISA changes: Key announcements in Reeves’ Budget

‘A kick in the teeth’: Readers say Reeves’ Budget ‘punishes responsibility’

Farage accused of ‘persistent’ racial abuse by schoolmate who rejects ‘banter’ claims

How the Budget will affect you: Winners and losers from Reeves’ speech