Debate about the future of virtual currencies is gaining momentum following the theft of about 58 billion yen worth of it from Coincheck Inc., a virtual currency exchange service provider. Are virtual currencies a service that Japan ought to develop? What forms of regulation are desirable? The Yomiuri Shimbun asked experts about these questions and the future of blockchain technology, upon which virtual currencies are based. The following are excerpts from the interviews.

===

Regulation of margin trading needed

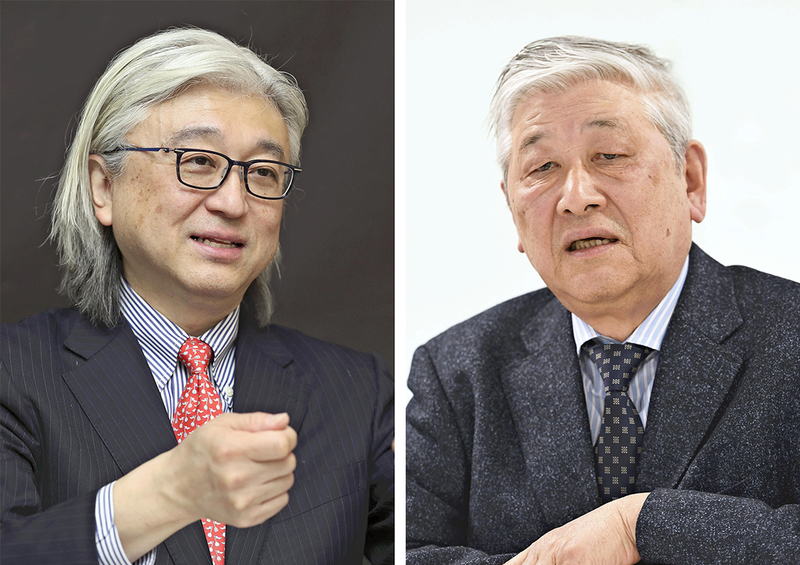

Yukio Noguchi / Emeritus Professor at Hitotsubashi University

The original role of virtual currencies was to make it possible to send money anywhere in the world easily at a low cost. However, because the value of virtual currencies has risen, the cost of sending them has also gone up. Therefore, it can no longer fulfill their original role, and is now meaningful only as a speculative asset. This is a big problem. I think this is a kind of suicidal state for virtual currencies.

The Financial Services Agency enforced the revised Payment Services Law partly with the intention of fostering virtual currencies, but because that was seen as government approval, it unintentionally ended up spurring speculation.

Regulations for virtual currencies speculation ought to be strengthened. There is a system called margin trading (see below) where a low amount of capital can be traded for 10 to 20 times its sum in virtual currency. That's what caused last year's speculation to occur.

Retail foreign exchange trading, which has the same system, allows investment decisions to be made according to various economic indicators, but virtual currencies lack these indicators, and therefore it is mere speculation. First of all, the ratio at which virtual currencies can be purchased ought to be restricted or, if possible, margin trading ought to be prohibited.

Virtual currencies that can be exchanged at a rate equivalent to the Japanese yen, such as the megabanks are trying to provide, is highly desirable. There would be no speculation according to price fluctuations and it would probably be possible to send money at extremely low costs. This would be extremely convenient and have a great impact on the world.

If payments of 10 yen and 20 yen could be made, many different services could be provided over the internet. It would be possible when distributing content [such as news and videos] for a fee, to sell content piece by piece for a small sum of money. Paying 10 yen is easier than being told to "register for membership to keep viewing this content."

In China, "digital money" is growing at a rapid rate. Alipay, a service where you make payments using your smartphone, is also being introduced into parts of Southeast Asia, and it's altogether possible it will take the world by storm.

In Japan, however, attention has been concentrated only on virtual currency speculation, and this critical situation is going unrecognized. Human resources for blockchain, the technology upon which virtual currencies are based, have not even been trained. This is a desperate situation. Megabanks ought to hurry toward developing their own virtual currencies; there is no grace period for dawdling.

--- Yukio Noguchi

Graduated from the Faculty of Engineering at the University of Tokyo in 1963 and earned his doctorate in economics at Yale University. Since working at the previous iteration of the Finance Ministry, Noguchi has been a professor at the University of Tokyo and a visiting professor at Stanford University, in addition to serving in other posts. He serves as an adviser for Waseda University's Institute for Business and Finance. Noguchi specializes in finance theory and the Japanese economy. He is 77.

===

Unfit for financial payments

Junichi Shukuwa / Professor at Teikyo University

The recent incident has cast into sharp relief a big problem concerning virtual currencies and the blockchain technology upon which they are based. Despite the fact that virtual currencies are often used for speculative purposes, user protection is insufficient.

Even if the payee account for stolen virtual currencies is known, stolen currency cannot be retrieved. This is a world where established financial thinking does not apply.

The market rate for virtual currencies fluctuates violently, and it's on its way to becoming like a high risk financial product. This is because, as monetary easing by central banks occurs on a global scale, there is a lot of money circulating and money without a destination is flowing into virtual currencies.

In Japan, the revised Payment Services Law defines virtual currencies as a property value, rather than a financial product. In fact, while there are people who need to use it as an investment, it cannot be used for payments.

The larger trend in finance is headed toward digitization. It's fine for virtual currencies to be used for payments, but if they're a speculative entity the way they are now, they will continue to be bought only by a certain group of people.

The word "virtual currencies" is inappropriate. A currency is money to which laws apply; only monies such as the yen and the dollar can be called currency. If anything, this is "virtual money."

Virtual currencies should be treated as a highly speculative product, as a thing. It would be preferable to put customer protection first by making exchange service providers pass an extremely rigorous examination before being allowed to enter the marketplace.

In the first place, blockchain technology is inappropriate for finance in its current form.

Blockchain is managed through computers that are dispersed across the world, so it's believed to keep working even when part of it has been subjected to a cyber-attack.

It's therefore been considered difficult to falsify, and I think many people feel it's safe because of this. However, theft of virtual currencies has been occurring successively all over the world, and there's no way of getting that stolen money back.

There are also issues such as the low number of trades that can be processed at one time, and the fact that in principle the content of completed trades cannot be rewritten later.

The settlement system created by banks all over Japan has the capacity to process about 6 million trades a day; stock exchanges can process even more. Blockchain cannot be used in places like this.

It's not my intention to entirely reject new technology, but depending upon the field, there are differences in where it's fit or unfit to be used.

--- Junichi Shukuwa

Graduated from Keio University's Faculty of Economics in 1987 and entered Fuji Bank (now Mizuho Bank). Joined Sanwa Bank (now the Bank of Tokyo-Mitsubishi UFJ) in 1998. In addition to being a professor at Teikyo University, he also works as a part-time lecturer at Keio University. Shukuwa's specializations include international finance, currency and payments. He is 54.

-- Margin trading

A system where money (a margin deposit) is deposited in advance with a broker as collateral in order to trade a sum of money larger than the amount of deposited funds.

The highest ratio at which the deposit can be traded is called leverage. For example, at virtual currencies exchange service provider bitFlyer, the maximum ratio is 15 times the amount of deposit money. This means that 1 million yen can be used to buy 15 million yen in virtual currencies.

A low amount of funds can be used to make a large profit, but if prices plummet it's possible to lose the entire sum.

The same system exists in retail foreign exchange trading. The Financial Services Agency restricts the maximum ratio to 25 times the amount of deposited funds, but it is considering further restricting this to 10 times as a means of restraining excessive speculation.

(From The Yomiuri Shimbun, Feb. 20, 2018)

Read more from The Japan News at https://japannews.yomiuri.co.jp/