/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

Alphabet (GOOG) (GOOGL) has lagged behind other Magnificent 7 tech stocks in 2025, but a deeper look reveals that Google might just be one of the most underappreciated artificial intelligence (AI) opportunities in the market right now.

What’s Happening With Google?

Google’s market share in search recently dipped below 90% for the first time since 2015, causing concern over its core ad model.

But Google is fighting back by introducing AI Overviews, Gemini integrations, and launching free AI training with the State of Virginia. This diversification strategy could help secure long-term relevance in a rapidly changing tech landscape.

Congress is Buying the Dip

Congressmen Ro Khanna and John Boozman disclosed purchases of GOOGL stock in May and June. Since those trades, the stock has rallied over 15%, though it's still negative YTD.

This activity is tracked on Barchart’s Politician Insider Trading page, giving you transparency into what influential policymakers and committee members are doing behind the scenes.

Key Technical Indicators Turning Bullish

Alphabet stock recently reclaimed its 200-day moving average – a traditionally bullish technical signal.

Plus, the 14-day Relative Strength Index (RSI) is climbing back above 50, with positive sloping moving averages.

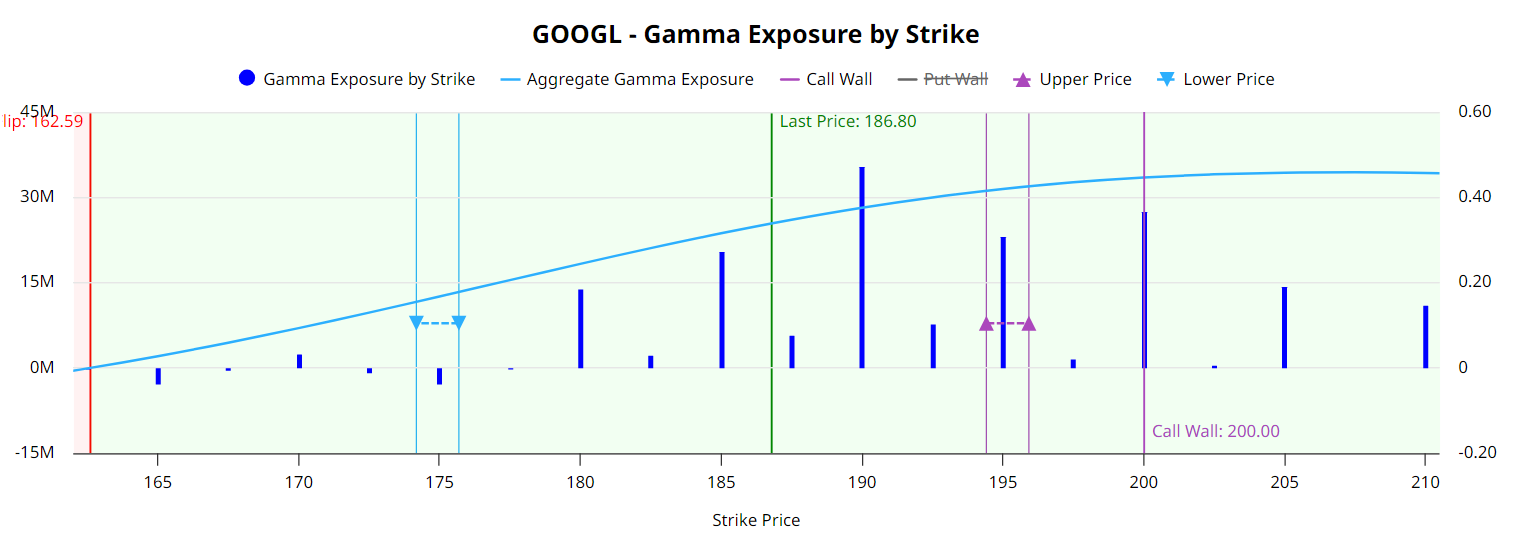

Call option activity is also rising, with key gamma levels forming around the $190–$200 strikes.

Barchart’s Gamma Exposure Tool can help traders to monitor these critical resistance and breakout levels.

Bottom Line

Alphabet might be the underdog of the AI race — but its fundamentals remain solid, and momentum is quietly building ahead of earnings on July 23:

If the stock breaks above $190, it could mark the beginning of a new bullish trend. Track the breakout potential using Barchart’s interactive tools.