Family businesses constitute a vital component of Canada’s economic landscape. They make up 63 per cent of privately held firms, employ nearly seven million people and generate about $575 billion a year.

While Canadian family-run businesses express international ambitions, their overseas engagement tends to be more conservative compared to their non-family counterparts.

In today’s turbulent economic environment — marked by geopolitical tensions, technological disruption and shifting trade patterns — international competitiveness is more important than ever.

Around the world, family firms have shown remarkable resilience in the face of external shocks. Some of the world’s longest-standing corporations are family-owned, having endured world wars, revolutions, natural disasters and pandemics. For Canadian family firms aspiring to expand abroad, such examples offer both inspiration and insight.

Among such long-standing multinationals is Rothschild, a centuries-old European family-run investment bank. Our case study of Rothschild, based on historical analysis, highlights how the family’s enduring relationships, reliable routines and long-term goals gave it significant advantages in international business.

At the same time, however, families can contribute unique biases, especially “bifurcation bias” — a tendency to favour family resources over equally or more valuable non-family ones. Our study reveals that bifurcation bias can compromise a firm’s international trajectory, especially in distant and complex markets.

A brief history of Rothschild

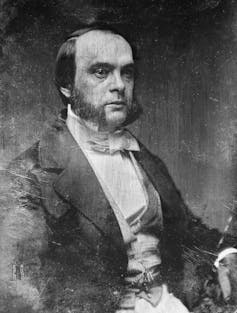

Initially a merchant business, the firm was founded in the late 18th century by Mayer Amschel Rothschild, a Frankfurt Jew.

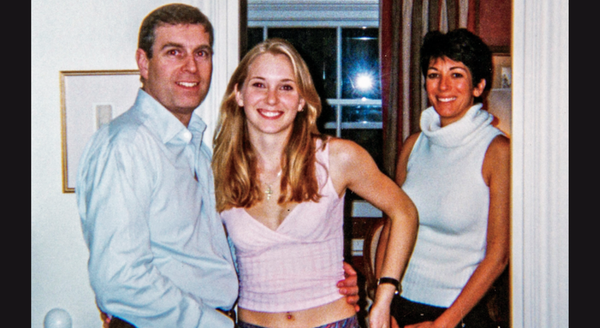

Rothschild and his wife, Guttle, had 10 children, including five sons: Amschel, Salomon, Nathan, Carl and James.

In 1798, Rothschild sent Nathan to Manchester, England, which initiated the firm’s growth in that country and a transition from merchant operations to financial transactions.

By the 1820s, Rothschild became a multinational bank, with Amschel, Salomon, Nathan, Carl and James leading banking houses in Frankfurt, Vienna, London, Naples and Paris, respectively.

Bonuses and burdens of family bonds

In the 19th century, the Rothschild’s strategy of relying on family members initially worked well for the firm.

The five Rothschild brothers corresponded in a coded language and shared a common pool of resources at a time when shared balance sheets were uncommon in international banking.

Their close familial bonds allowed the brothers to move information, money and goods across international borders with a speed and reach that wasn’t accessible to competitors. Rivals, by contrast, had to worry about protecting sensitive information and enforcing commitments.

This internal cohesiveness safeguarded the Rothschild’s business, facilitated transactions and allowed them to maintain resilience through the periods of significant political upheaval: the Napoleonic wars, revolutions and, ultimately, the First World War, which interrupted economic and social progress in Europe.

However, this same over-reliance on family became a disadvantage when Rothschild expanded into the United States.

Missed opportunity and bifurcation bias

The Rothschilds showed an interest in the American market as early as the 1820s. However, their repeated attempts to send family members to the U.S to expand operations failed, as none were willing to stay, preferring the comforts of European life.

Since they were unable to establish a family-based anchor in the country, the Rothschilds appointed an agent, August Belmont, to run the U.S. operations on their behalf in 1837.

However, Belmont wasn’t given the authority to exercise entrepreneurial judgment, make investments or enter into deals. He also didn’t have unrestricted access to capital, was never entrusted with an official Rothschild mandate or acknowledged as a full-fledged partner.

The Rothschilds were unwilling to delegate such decisions to someone who was not a direct male descendant of the founder, Mayer Amschel Rothschild.

This failure to use Belmont as a link between the family — with its successful experiences, capabilities, routines and connections in Europe — and the American market — with its growing opportunities and the valuable networks Belmont had begun to develop — ultimately prevented Rothschild from replicating its success in the U.S.

The Rothschilds were eventually eclipsed by the Barings and JP Morgan banks in America. Both competitors followed a different path in the market by opening full-fledged U.S. subsidiaries under their corporate brands with significant funds and decision-making autonomy.

Escaping the trap of bifurcation bias

Bifurcation bias does not always have an immediate negative impact. In fact, biased governance practices remained inconsequential for the Rothschilds — as long as there were enough capable family heirs available to lead the bank’s dispersed operations.

In the short- to medium-term, the family’s connections, time-tested routines and mutual reliability built a well of resilience that sustained the bank through the 19th century, one of the most volatile political periods in European history.

But as a firm’s international ambitions outgrow the size of the family, bifurcation bias can damage competitiveness, both in international markets and at home.

At some point, family firms must shift from emotional, biased decision-making to efficient governance systems, which may involve incorporating non-family managers and selecting resources, locations and projects that do not carry emotional significance.

Many successful family firms implement tools in their governance systems to detect and eliminate biased behaviour. For instance, family-owned multinationals such as Merck (Germany), Cargill (U.S.) and Tata Group (India) have checks and balances that prevent decision-makers from thinking only in family terms.

The most successful strategies to safeguard against bifurcation bias invite outside scrutiny into corporate decision-making: appointing non-family CEOs, establishing independent boards, hiring consultants and granting partners decision-making powers.

Lessons for family firms

Today, as the global business environment faces arguably unprecedented volatility, firms are seeking to build resilience to survive the turbulence.

While multi-generational family firms must learn to guard against bifurcation bias to thrive in international markets, their demonstrated ability to withstand external shocks offers valuable lessons for other companies.

How can non-family firms emulate the Rothschild’s success and longevity? The Rothschild case teaches us the value of having a shared organizational language, setting long-term goals, maintaining stable routines and placing a strong emphasis on brand reputation.

These strategies can help any company, family-owned or not, build resilience during volatile times.

Liena Kano receives funding from SSHRC.

Alain Verbeke receives funding from SSHRC.

Luciano Ciravegna receives funding from INCAE Business School, where he leads the Steve Aronson Endowed Chair.

Andrew Kent Johnston does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.