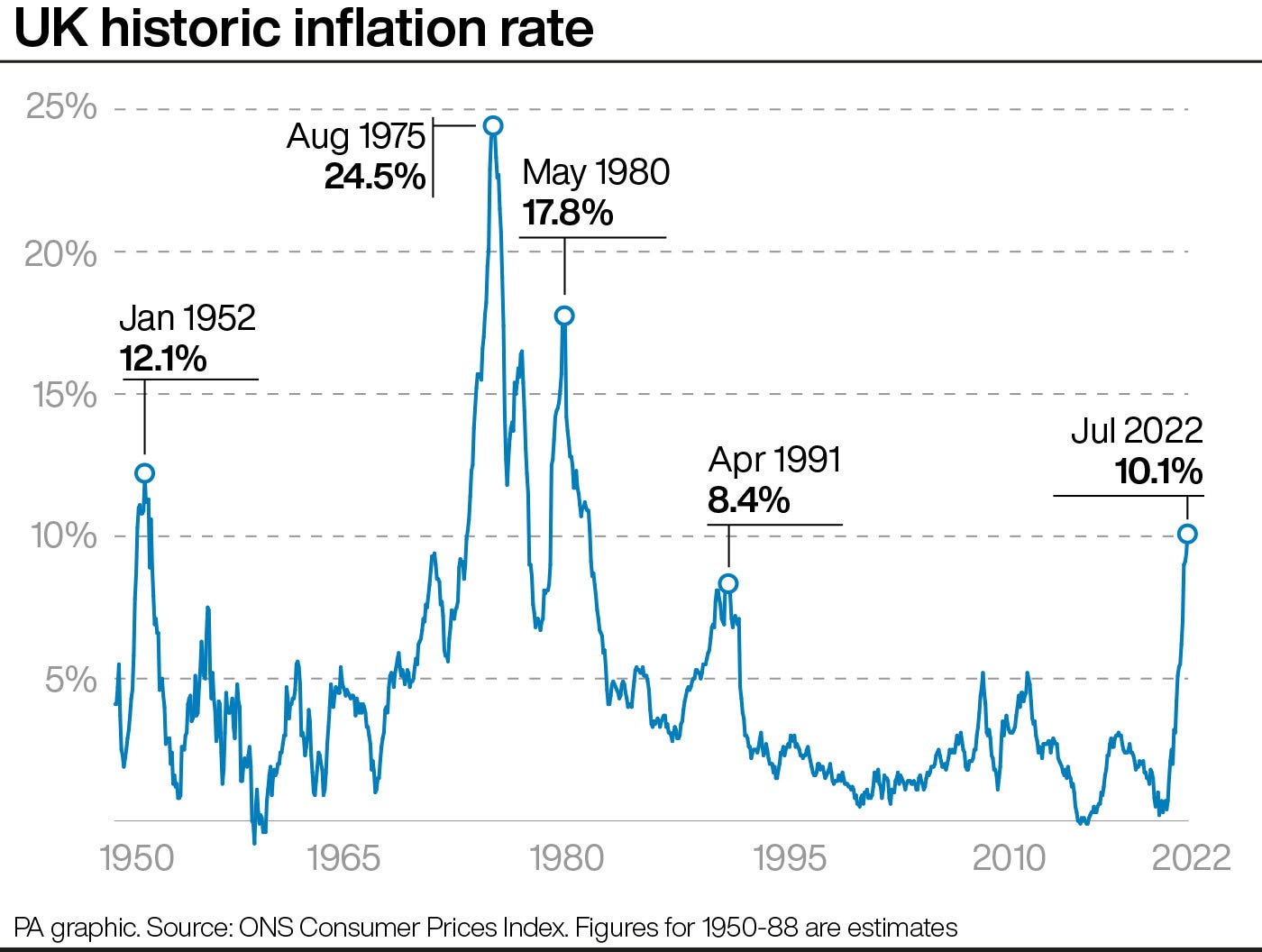

The UK rate of inflation remained high at 9.9 per cent for the 12 months to August, keeping it at its highest level for 40 years as the cost of living crisis continues to bite.

Despite a slight fall from July’s 10.1 per cent in response to volatile fuel prices, the situation will likely get worse before it improves, with the Bank of England (BoE) forecasting inflation to pass 13 per cent in the final quarter of this year.

The present spike means that the price of everyday items like staple foods, fuel, clothing, shoes and furniture have all climbed over the last year, a development that threatens to hit low-income families hardest at a time when they can least afford it.

Charities have already reported increased sales of and demand for second-hand clothes in response to increased production costs driving high street fashion to its priciest levels since 1988 when records began.

“The easing in the annual inflation rate in August 2022 reflected principally a fall in the price of motor fuels in the transport part of the index,” the Office for National Statistics (ONS) said on 14 September.

“Smaller, partially offsetting, upward effects came from price rises for food and non-alcoholic beverages, miscellaneous goods and services, and clothing and footwear.”

Rising costs, staff shortages and supply chain disruption are known to be affecting both big name retail brands and small businesses alike, leaving them with little choice, as they see it, but to pass on price rises to consumers to ensure their own survival.

ONS data has meanwhile revealed the extent to which UK wages have stagnated, with real pay falling 3 per cent in value between April in June, a rise in cash terms dwarfed by the soaring costs elsewhere.

Cost of living: How to get help

The cost of living crisis has touched every corner of the UK, pushing families to the brink with rising food and fuel prices.

- The Independent has asked experts to explain small ways you can stretch your money,including managing debt and obtaining items for free.

- If you need to access a food bank, find your local council’s website usinggov.uk and then use the local authority’s site to locate your nearest centre.The Trussell Trust, which runs many food banks, has a similar tool.

- Citizens Advice provides free help to people in need. The organisation can help you find grants or benefits, or advise on rent, debt and budgeting.

- If you are experiencing feelings of distress and isolation, or are struggling to cope, The Samaritans offers support; you can speak to someone for free over the phone, in confidence, on 116 123 (UK and ROI), email jo@samaritans.org, or visit the Samaritans website to find details of your nearest branch.

Private sector workers saw their pay rise 5.9 per cent before inflation – more than three times as fast as their counterparts in the public sector who received a 1.8 per cent increase.

The figures set the new Liz Truss government on course for further clashes with public servants including nurses, doctors, lawyers and teachers who have seen the value of their incomes collapse this year, adding to the pain of a decade of falling real wages.

“The scale of this pay pain is even deeper than official figures suggest too, as pay growth estimates are still artificially boosted by the effects of the furlough scheme last year”, said Nye Cominetti, senior economist at the Resolution Foundation.

“This squeeze has come about despite robust pay growth and a lively jobs market, with pay settlements strengthening slightly, and almost a million people moving jobs in the last three months.”

Ms Truss’s first move as prime minister to freeze Ofgem’s energy price cap, the maximum amount a utility company can charge an average customer per year, at £2,500 for two years will have provided some relief to households, which were facing another 80 per cent rise in their bills from 1 October in response to soaring global gas prices.

Had the regulator’s planned increase in the cap been allowed to proceed, it would have risen from £1,971 to £3,549 for a household on average usage, with those on prepayment meters charged even more.

The new PM has also pledged to honour former chancellor Rishi Sunak‘s package of aid measures for British households announced back in February as part of an attempt to soothe the “sting” of rocketing bills.

But after a summer of inaction, with the Tory leadership contest to choose Boris Johnson’s successor dragging on interminably while the incumbent preferred to go on multiple holidays rather than come to the electorate’s rescue, the nation remains in a state of crisis.

British consumers face flatlining wages and higher costs for everything from food, clothing, petrol, heating, housing and rent at a time when rising interest rates mean the cost of borrowing is going up too, most recently climbing another 0.5 percentage points to 2.25 per cent as the BoE’s Monetary Policy Committee moved to try to put the brakes on inflation.

While the current outlook appears bleak indeed, consumers are being encouraged to treat the present adversity, which will ultimately pass, as an opportunity to reassess their personal circumstances, streamline their finances and cut out any inessential regular outgoings.

“The most important thing savers can do now is review how this environment will affect their finances, where they are keeping their savings, and make adjustments as necessary,” said Colin Dyer, client director at Abrdn Financial Planning.

“For example, holding significant amounts of cash in a deposit account is effectively losing money in an inflationary environment, so depending on attitude to risk, investing in a stocks and shares ISA may provide a greater return if investing for the longer term.”