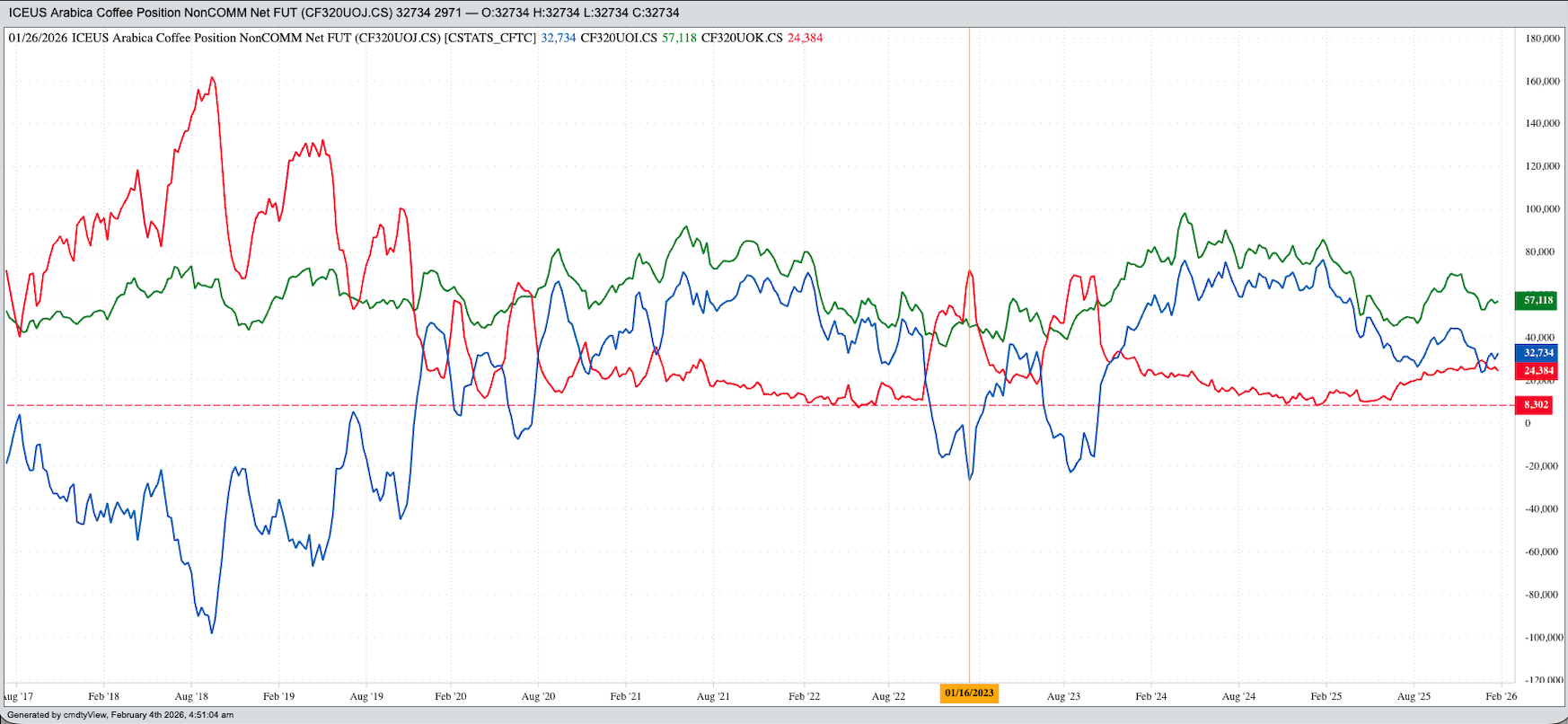

Coffee futures broke hard Tuesday, with selling tied to both sides of the market - commercial and noncommercial.

-

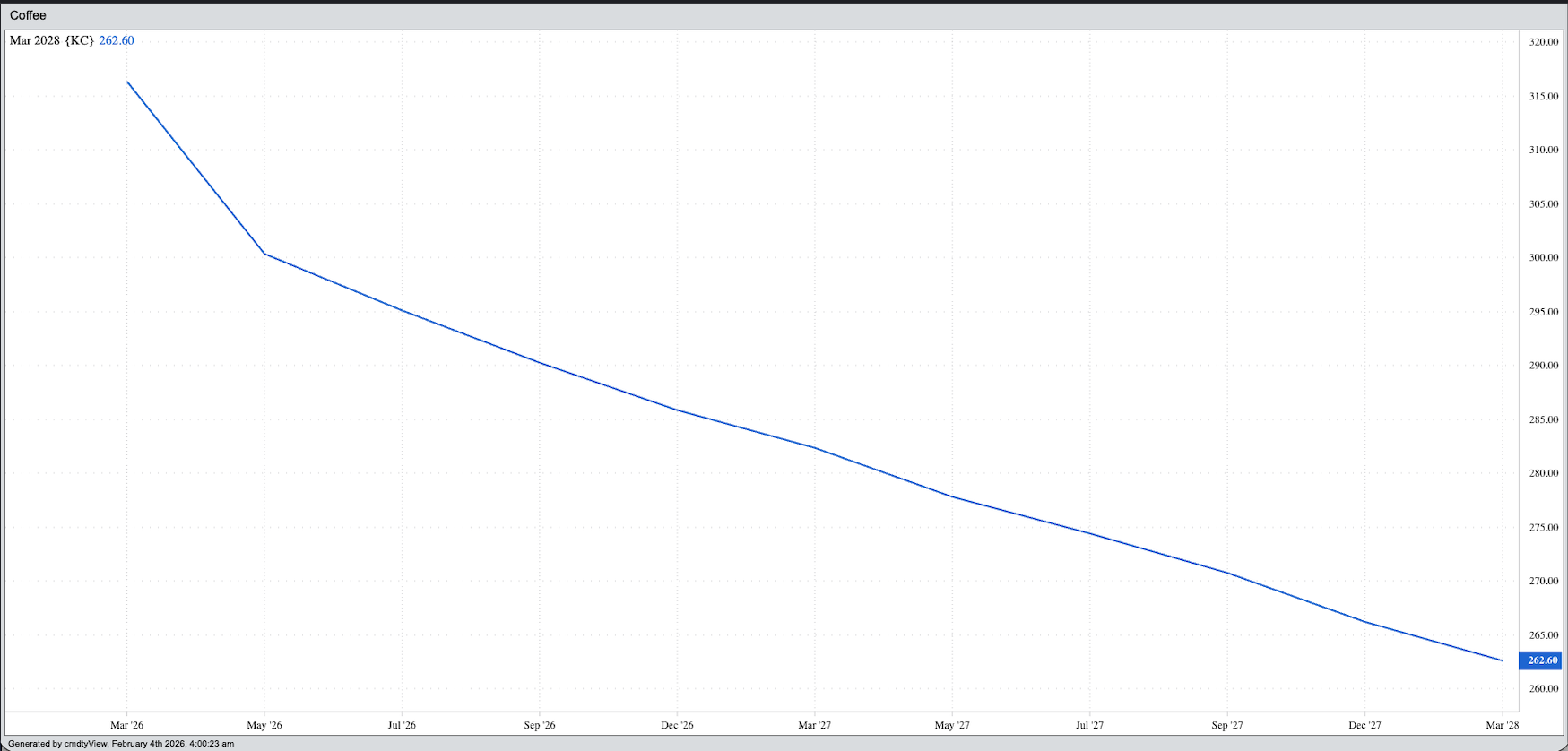

Despite the break in futures spreads, the market's forward curve remains in backwardation (inverted) telling us longer-term supply and demand remains bullish.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. Investors could view the selloff as a buying opportunity despite a turn to more favorable weather in Brazil.

Tuesday afternoon, a friend from central Nebraska called with a market question, but rather than corn, soybeans, cattle, and so on, he asked about coffee. Tuesday's close saw the market sharply in the red (per pound):

- March (KCH26) was down 16.15 cents (4.9%)

- May (KCK26) was down 14.15 cents (4.5%)

- July (KCN26) was down 12.85 cents (4.2%)

- We can see commercial interests were selling alongside noncommercial traders, as indicated by nearby contracts listing ground to deferred issues

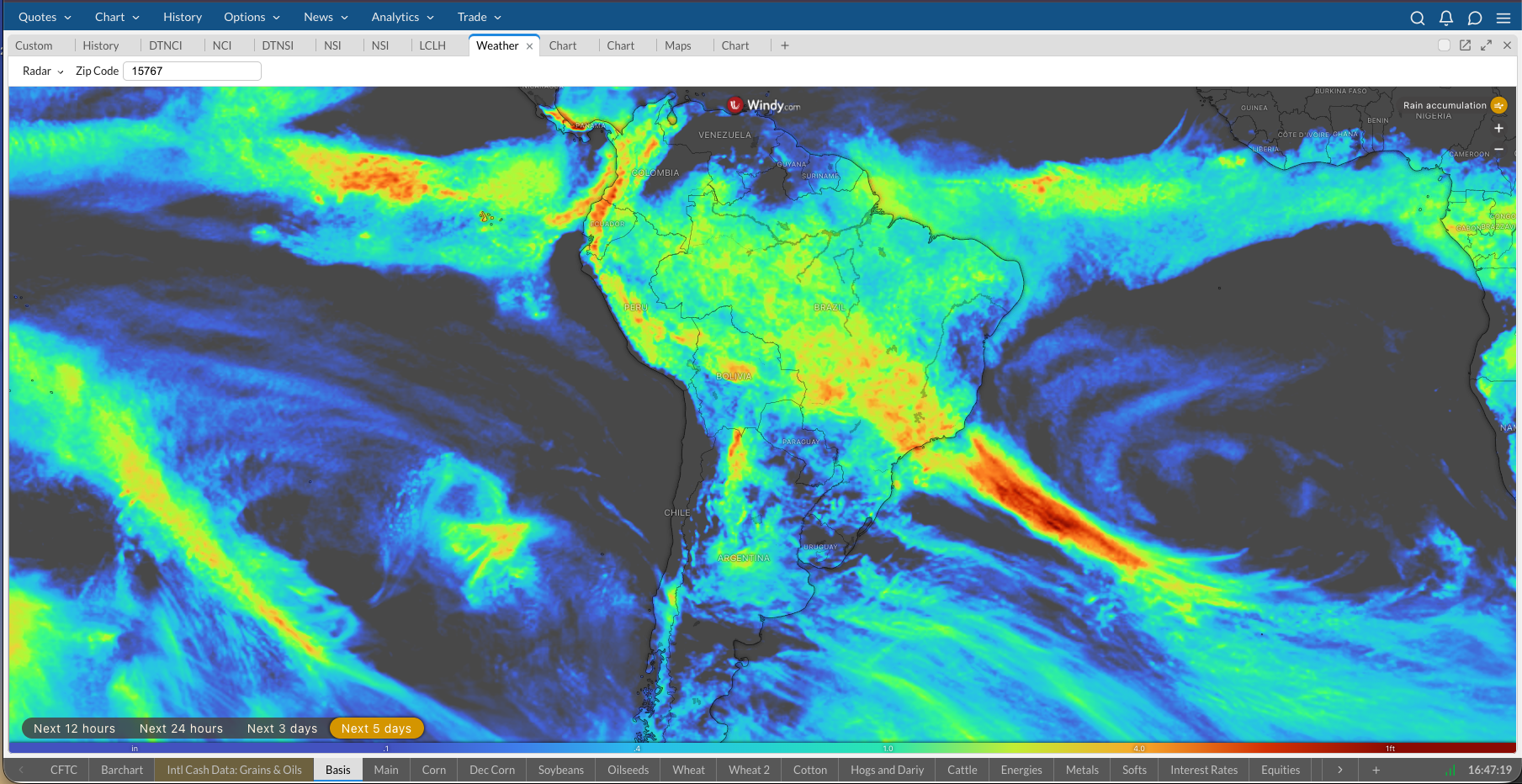

Keeping in mind coffee is a weather derivative, my Blink reaction was a change in weather patterns drove the market lower.

- Brazil is world's largest producer and exporter of coffee

- A look at the weather forecast for Brazil called for continued rains across much of the country

- Increasing Brazil's production potential

Despite Tuesday's sharp selloff in futures and commercial selling in futures spreads, the market's forward curve continues to show a strong inverse, backwardation in New York terms.

- This tells us coffee's supply and demand remains bullish, long-term

- With global demand for coffee still strong (particularly in my office)

- Given this, Watson could view the selloff as a buying opportunity

The latest Commitments of Traders report showed noncommercial traders held a net-long futures position of 32,734 contracts, an increase of 2,971 contracts as of Tuesday, January 27.

- This included an increase in long futures of 1,109 contracts

- And a decrease in short futures by 1,862 contracts

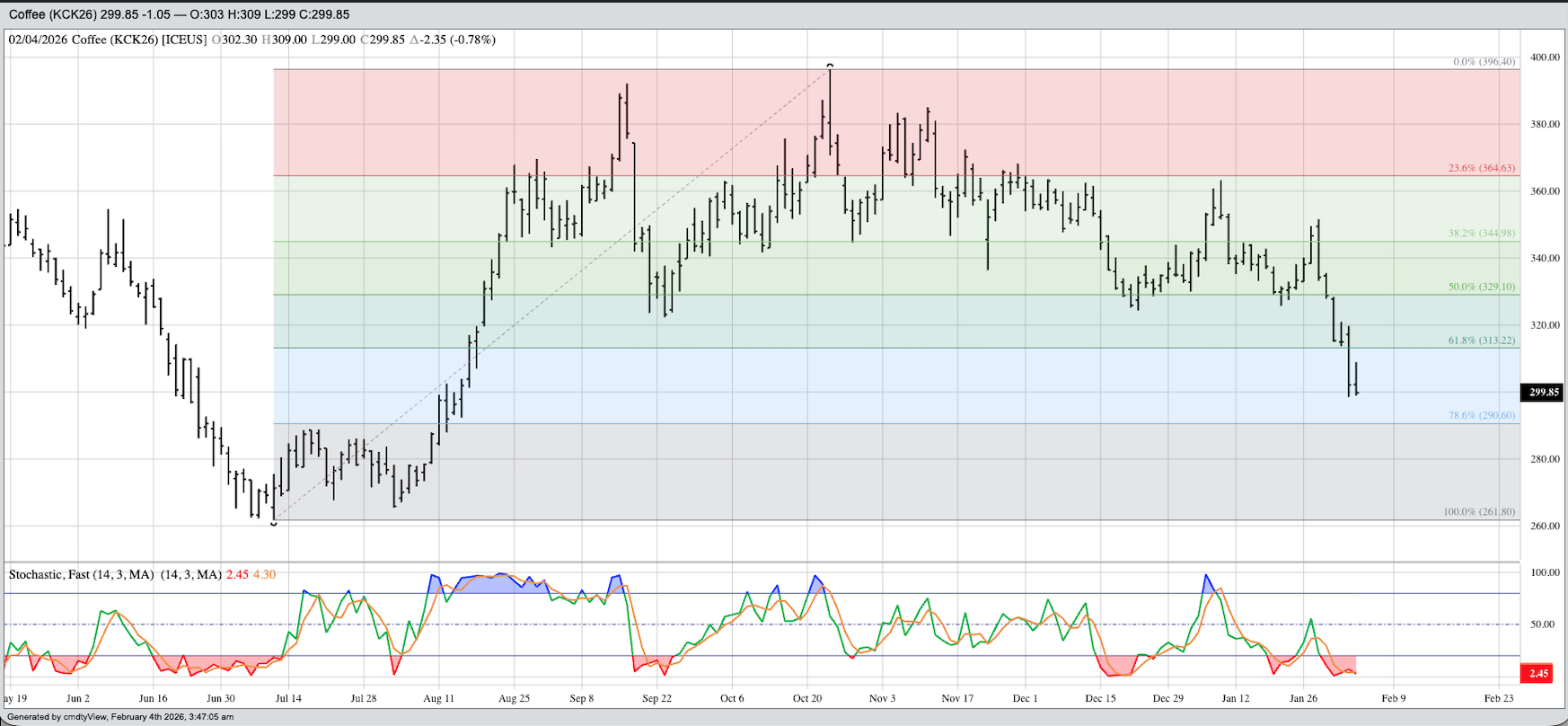

Overnight through early Wednesday morning finds the May issue holding Tuesday's low of 299.00 (cents per pound).

- Additionally, daily stochastics did complete a bullish crossover below the oversold level of 20% at Tuesday's close, indicating the minor (short-term) trend should turn up soon.

- From a technical point of view, I have no idea what type of reversal pattern to look for

- As for a possible price target, there is an old pocket of trade with a high just below 290.00 from last July that could act as support.

- Therefore, risk could be viewed as about 15.0 cents with the reward close to 30.0 cents, for a ratio of 1:2. This could also be viewed as attractive to Watson over the coming days.