/Visa%20Inc%20logo-by%20Cineberg%20via%20Shutterstock.jpg)

Visa Inc. (V), based in San Francisco, is a global payment technology company with a market cap of $599.2 billion. Operating in over 200 countries, it facilitates secure, fast transactions through its advanced technology and global infrastructure, enabling digital money movement and supporting commerce worldwide.

Despite its reputation as a global payments powerhouse, Visa has struggled to keep pace with the broader market over the past year. Visa has declined 4.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.4%. Moreover, on a YTD basis, the stock is down 6.2%, compared to SPX’s 1.1% uptick.

Nonetheless, zooming in further, V has outpaced the Amplify Digital Payments ETF(IPAY), which has dipped 23.7% over the past year and 10.9% on a YTD basis.

On Jan. 29, Visa shares popped 1.5% after the company reported its fiscal 2026 Q1 results. Its net revenue of $10.9 billion increased 15% year over year, driven by resilient consumer spending, robust holiday shopping, and higher payments and cross-border volumes. Adjusted EPS of $3.17 also grew 15% and beat analyst expectations. Payment volume expanded about 8%, processed transactions rose 9%, and cross-border volumes climbed 12%, highlighting broad demand across its network.

For fiscal 2026, ending in September, analysts expect V’s EPS to grow 11.9% year over year to $12.83. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

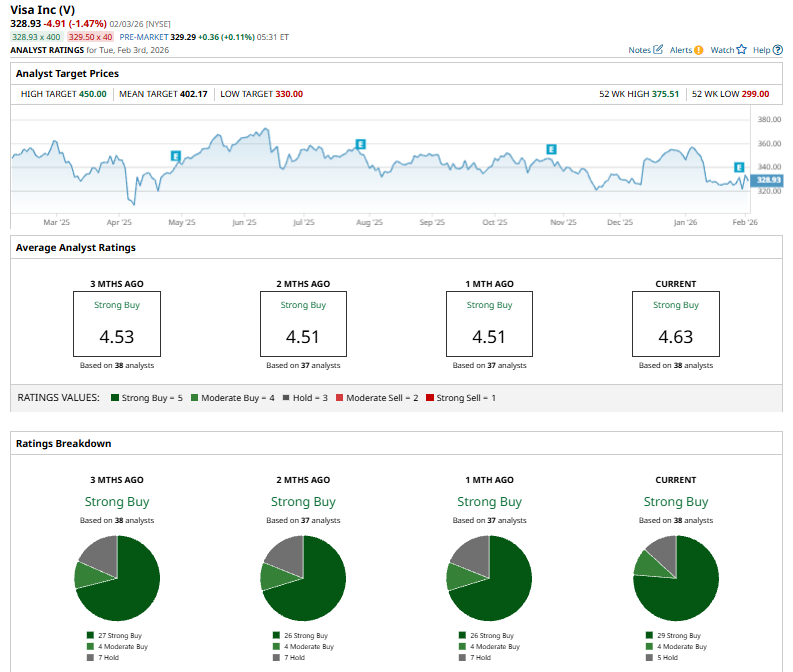

Among the 38 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 29 “Strong Buy,” four “Moderate Buy,” and five "Hold” ratings.

This configuration is slightly bullish than a month ago, with 26 analysts suggesting a “Strong Buy” rating.

On Feb. 3, RBC Capital Markets analyst Daniel Perlin reiterated a “Buy” rating on Visa, setting a $395 price target.

The mean price target of $402.17 represents an 22.3% premium from V’s current price levels, while the Street-high price target of $450 suggests an upside potential of 36.8%.