/Tractor%20Supply%20Co_%20storefront%20by-%20TennesseePhotographer%20via%20iStock.jpg)

Valued at $33 billion by market cap, Tractor Supply Company (TSCO) is the largest rural lifestyle retailer in the U.S., operating over 2,300 stores across 49 states along with its Petsense chain. Founded in 1938, the Brentwood, Tennessee-based company caters to farmers, ranchers, pet owners, and outdoor enthusiasts, offering products ranging from animal care and farm equipment to apparel, tools, and garden supplies.

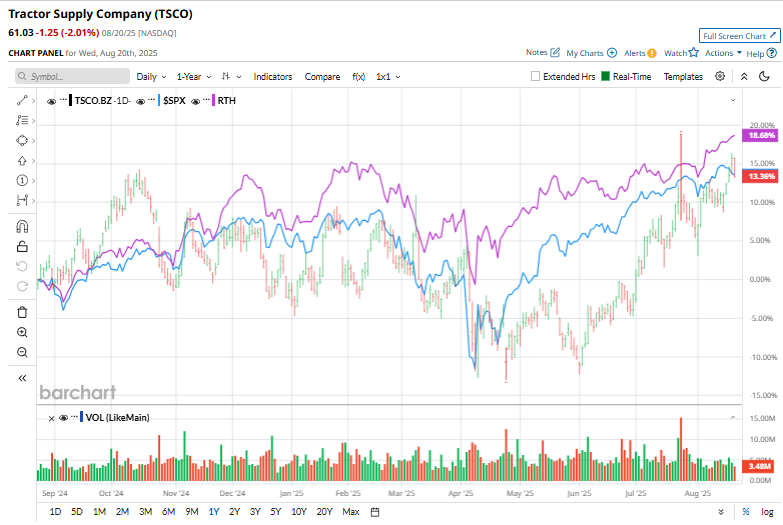

Shares of TSCO have outperformed the broader market over the past year, surging 15.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, TSCO stock is up 15%, compared to the SPX’s 8.7% rise on a YTD basis.

Narrowing the focus, TSCO has underperformed the VanEck Retail ETF (RTH). The exchange-traded fund has gained about 20.1% over the past year and 11.3% in 2025.

On Jul. 24, Tractor Supply released its second-quarter earnings and its shares dipped 2.1% in the next trading session. It posted revenue of $4.44 billion, up 4.5% year-over-year, and an EPS of $0.81, slightly above estimates. Growth was driven by a 1.5% increase in comparable store sales, supported by higher transaction volumes and an increase in average ticket size. Profitability also improved, with gross profit up 5.4% to $1.64 billion and margins expanding to 36.9%.

The company added 24 new Tractor Supply and 2 Petsense stores during the quarter and reaffirmed its full-year guidance, projecting net sales growth of 4–8%, comparable sales growth of 0–4%, and EPS in the range of $2–$2.18, signaling confidence in sustained growth momentum.

For the current fiscal year, ending in December, analysts expect TSCO’s EPS to grow 2.9% to $2.10 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

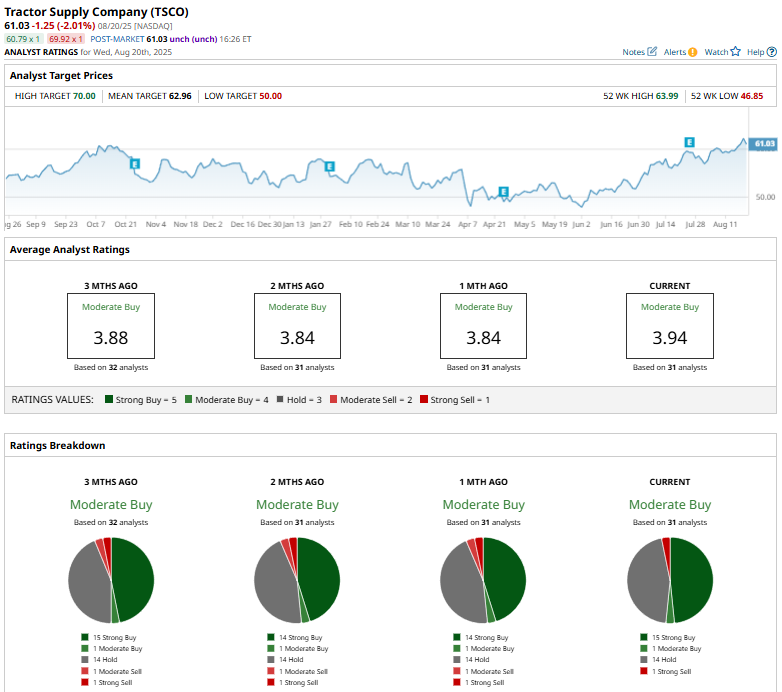

Among the 31 analysts covering TSCO stock, the consensus is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” 14 “Holds,” and one “Strong Sell.”

The configuration is more bullish than a month ago, when 14 analysts had suggested a “Strong Buy” for the stock.

On July 25, Loop Capital raised its price target for Tractor Supply from $48 to $60, while keeping a “Hold” rating. The upgrade followed stronger-than-expected Q2 results, driven by higher average ticket size and solid sales of high-value items. Analysts noted an improvement in confidence as management projected stronger top-line growth for the second half of the year.

The mean price target of $62.96 represents a 5.8% premium to TSCO’s current price levels. The Street-high price target of $70 suggests an upside potential of 22.9%.