Valued at a market cap of $227.4 billion, T-Mobile US, Inc. (TMUS) is one of the largest wireless carriers in the United States, known for its nationwide 5G network and customer-focused, value-driven approach. Headquartered in Bellevue, Washington, the company offers mobile voice, messaging, and data services to consumers and businesses.

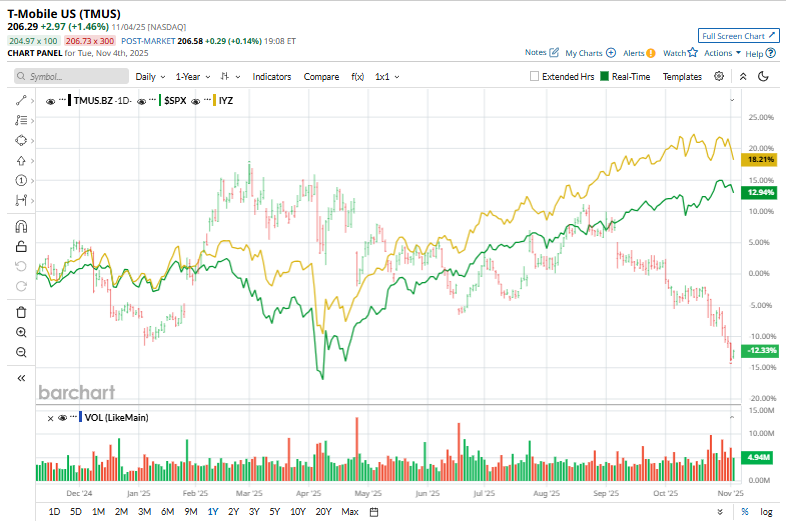

T-Mobile hasn’t exactly dialed up investor excitement lately. Over the past 52 weeks, TMUS stock has fallen 8%, while the broader S&P 500 Index ($SPX) has gained 18.5%. Moreover, on a YTD basis, TMUS is down 6.5%, compared to SPX’s 15.1% return.

Even within its own turf, the stock has struggled to keep pace with the iShares U.S. Telecommunications ETF’s (IYZ) 24% uptick over the past 52 weeks and 19.5% rise on a YTD basis.

On Oct. 23, T-Mobile released its FY2025 third-quarter earnings, and its shares dipped 3.3%. Its revenue improved 8.9% to $22 billion and service revenue climbed over 9%, supported by robust postpaid growth and record net additions of about 2.3 million customers, including 1 million postpaid phone adds. Core adjusted EBITDA increased around 6% to about $8.7 billion, though net income declined 11.3% to $2.7 billion, reflecting higher costs and heavier investment. The company boosted its full-year outlook for core adjusted EBITDA to $33.7 billion–$33.9 billion, underscoring confidence in sustained momentum.

For the current fiscal year, ending in December, analysts expect TMUS’ EPS to grow 6.1% year over year to $10.25. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

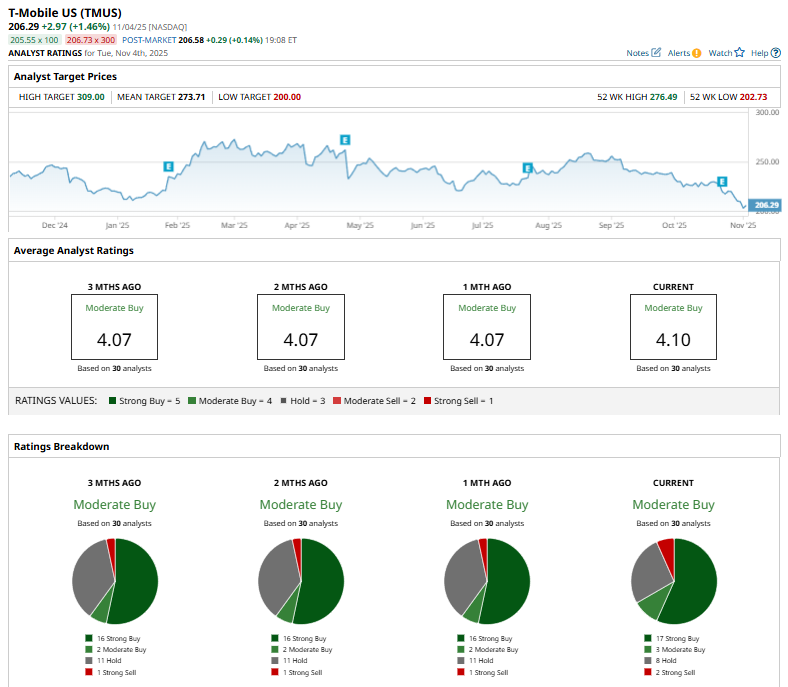

Among the 30 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 17 “Strong Buy,” three "Moderate Buy,” eight “Hold,” and two “Strong Sell” ratings.

This configuration is slightly more bullish than a month ago, with 16 analysts suggesting a “Strong Buy” rating.

On Oct. 16, Bernstein analyst Laurent Yoon reiterated a “Hold” rating on T-Mobile US and set a $265 price target.

The mean price target of $273.71 represents a 32.7% premium from TMUS’ current price levels, and the Street-high price target of $309 suggests an ambitious upside potential of 49.8%.