/Steris%20Plc%20logo%20and%20chart-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Mentor, Ohio-based STERIS plc (STE) is a leading global provider of infection prevention, sterilization, and procedural products and services, primarily serving healthcare institutions, pharmaceutical manufacturers, and research labs. Valued at $24.5 billion by market cap, the company specializes in enhancing patient safety and operational efficiency in sterilization processes, with solutions ranging from surgical instruments and sterilizers to maintenance services and cleanroom technologies.

Shares of STE have underperformed the broader market over the past year. STE has surged 5.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.1%. However, in 2025, STE stock is up 20.9%, surpassing the SPX’s 9.9% rise on a YTD basis.

Narrowing the focus, STE’s underperformance is also apparent compared to the iShares U.S. Medical Devices ETF (IHI). The exchange-traded fund has gained about 7.3% over the past year. But, the ETF’s 6.6% gains on a YTD basis lag the stock’s returns over the same time frame.

On Aug. 6, STERIS released its FY 2026 first-quarter earnings, with revenue rising 9% to $1.39 billion (8% organic growth) and adjusted EPS climbing 15% to $2.34, driven by solid performance across all segments, especially Applied Sterilization Technologies and Healthcare. Thanks to margin expansion, strong pricing, and operational efficiencies, the company raised its full-year revenue growth outlook to 8–9% (from 6–7%) and boosted its free cash flow forecast to $820 million, reflecting confidence. Shares of STE surged 6.8% in the next trading session.

For the current fiscal year, ending in March, analysts expect STE’s EPS to grow 8.9% to $9.08 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

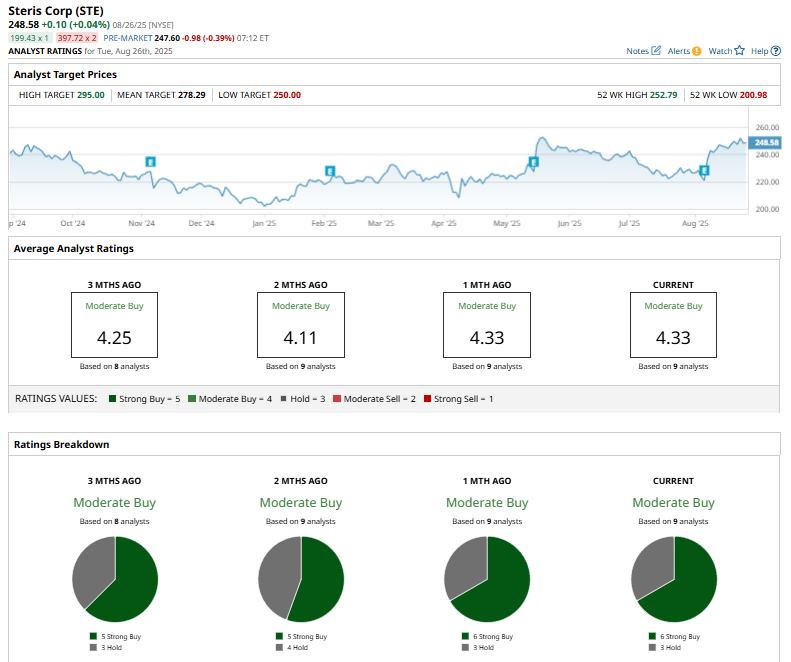

Among the nine analysts covering STE stock, the consensus is a “Strong Buy.” That’s based on six “Strong Buy” ratings and three “Holds.”

The configuration is more bullish than two months ago, when five analysts had recommended a “Strong Buy” for the stock.

On Jul 15, Morgan Stanley analyst Patrick Wood upgraded Steris from “Equal-Weight” to “Overweight” and raised the price target from $260 to $276.

The mean price target of $278.29 represents a 12% premium to STE’s current price levels. The Street-high price target of $295 implies an upswing potential of 18.7% from the current market prices.