Valued at $19.1 billion by market cap, McCormick & Company, Incorporated (MKC) is a global flavor and spice leader, producing and distributing seasonings, condiments, and flavor solutions to consumers, food manufacturers, and restaurants worldwide. Founded in 1889 and based in Hunt Valley, Maryland, the company operates through its Consumer and Flavor Solutions segments, with a portfolio of iconic brands like McCormick, French’s, and Frank’s RedHot.

Shares of MKC have underperformed the broader market over the past year. MKC has declined 8.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. In 2025, MKC stock is down 5.2%, compared to SPX’s 10% rise on a YTD basis.

Narrowing the focus, MKC has outpaced the First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has plunged 8.5% over the past year.

On June 26, MCK delivered a solid second-quarter, with net sales rising 1% to $1.66 billion (2% organic growth), driven by strength in its Consumer segment, while Flavor Solutions remained flat. Adjusted operating income climbed 10% to $259 million on cost savings and lower SG&A, though gross margin slipped 20 basis points due to higher costs. Adjusted EPS held steady at $0.69, slightly topping expectations.

The company reaffirmed its full-year outlook for 0–2% sales growth and adjusted EPS of $3.03–3.08, signaling confidence in mitigating cost pressures and sustaining performance. The upbeat results drove a 5.3% jump in the stock following the earnings release.

For fiscal 2025, ending in November, analysts expect MKC’s EPS to grow 3.1% to $3.04 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters, while missing in the recent quarter.

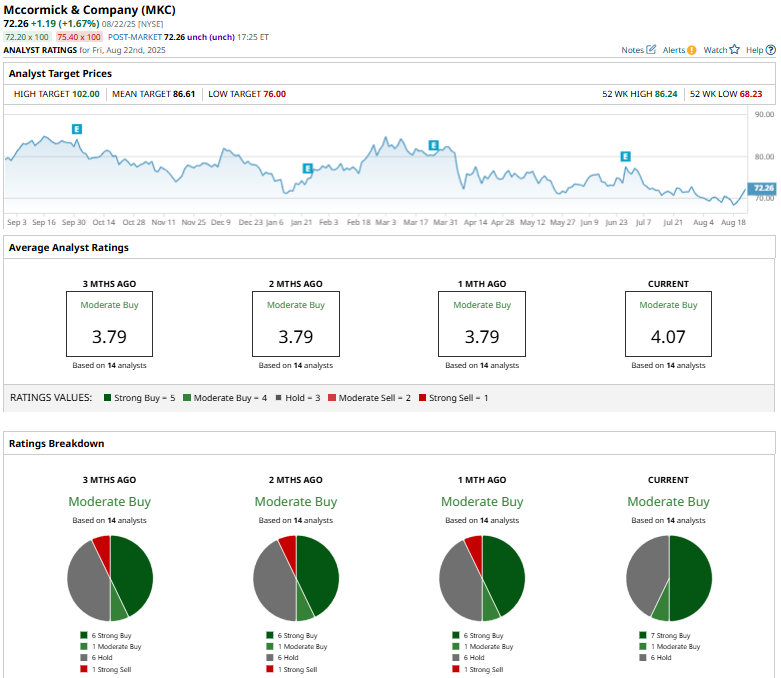

Among the 14 analysts covering MKC stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

This configuration is bullish than a month ago, with six analysts suggesting a “Strong Buy.”

On August 22, UBS analyst Bryan Adams reaffirmed a “Neutral” rating on McCormick and lowered the stock’s price target from $83 to $79, a 4.82% reduction.

The mean price target of $86.61 represents a 19.9% premium to MKC’s current price levels. The Street-high price target of $102 suggests an upside potential of 41.2%.