/Huntington%20Bancshares%2C%20Inc_%20location-by%20Eric%20Glenn%20via%20Shutterstock(1).jpg)

With a market cap of $24.2 billion, Huntington Bancshares Incorporated (HBAN) is a diversified regional bank holding company. Through its subsidiary, The Huntington National Bank, it provides a wide range of commercial, consumer, and wealth management financial services across multiple states in the U.S.

The Columbus, Ohio-based company's shares have lagged behind the broader market over the past 52 weeks. HBAN stock has risen 9.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied over 17%. In addition, shares of Huntington Bancshares are up 1.9% on a YTD basis, compared to SPX’s 8.2% gain.

Looking closer, the regional bank holding company stock has also underperformed the Financial Select Sector SPDR Fund’s (XLF) 19.6% return over the past 52 weeks and 8.5% increase on a YTD basis.

Despite reporting Q2 2025 adjusted EPS of $0.38 that matched the consensus estimate and better-than-expected revenue of over $2 billion, HBAN shares fell 1.6% on Jul. 18 due to rising non-interest expenses, which increased 7% year-over-year. Non-interest income also declined 4%, and credit quality showed mixed results, with a 3% rise in credit loss provisions and a 9.2% increase in non-performing assets. Additionally, a $58 million hit from securities repositioning reduced pre-tax earnings and impacted EPS, raising investor concerns.

For the current fiscal year, ending in December 2025, analysts expect HBAN’s adjusted EPS to grow 18.6% year-over-year to $1.47. The company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

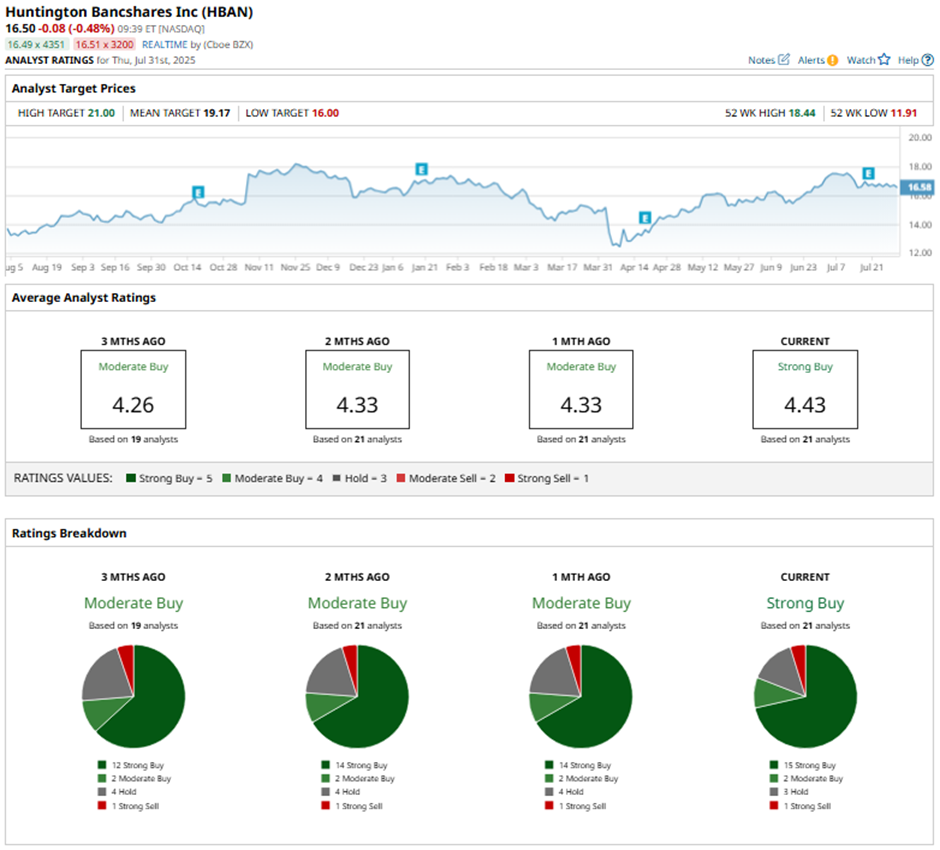

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buy” ratings, two “Moderate Buys,” three “Holds,” and one “Strong Sell.”

On Jul. 10, JPMorgan raised its price target on Huntington Bancshares to $18 while maintaining an “Overweight” rating.

As of writing, the stock is trading below the mean price target of $19.17. The Street-high price target of $21 implies a potential upside of 27.3% from the current price levels.