/Ford%20Motor%20Co_%20logo%20by-%20Vera%20Tikhonova%20via%20iStock.jpg)

Ford Motor Company (F), headquartered in Dearborn, Michigan, develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles. Valued at $45.1 billion by market cap, the company also provides vehicle-related financing, leasing, and insurance.

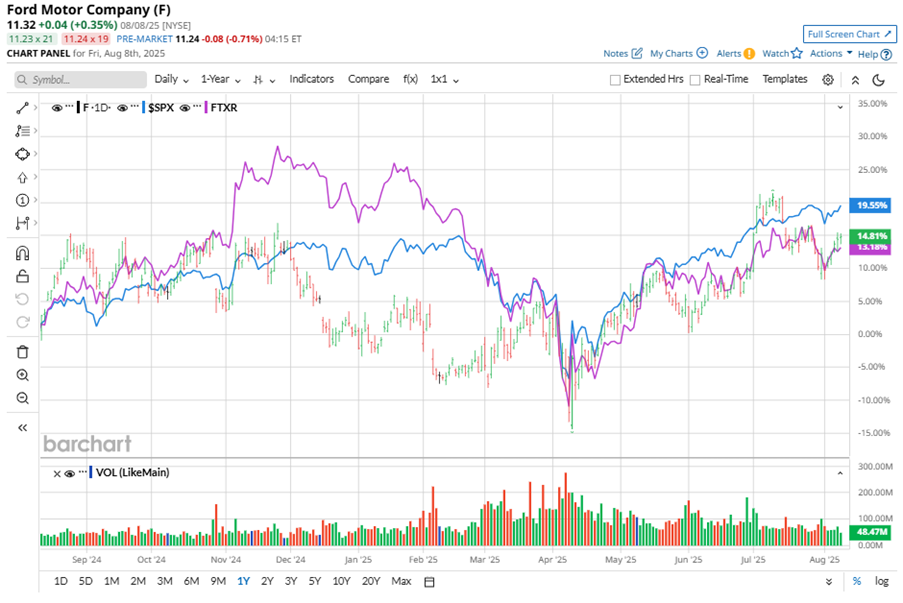

Shares of this auto giant have underperformed the broader market over the past year. F has gained 11.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 20.1%. However, in 2025, F stock is up 14.3%, surpassing the SPX’s 8.6% rise on a YTD basis.

Narrowing the focus, F’s underperformance looks less pronounced compared to the First Trust Nasdaq Transportation ETF (FTXR). The exchange-traded fund has gained about 11.9% over the past year. However, F’s double-digit gains on a YTD basis outshine the ETF’s 5% losses over the same time frame.

There are several factors contributing to F's underperformance, beyond just tariff fears. Ford's electric vehicle business is operating at a loss, and increasing recall costs are further eroding margins, adding to the company's woes.

On Jul. 30, F shares closed down by 1.9% after reporting its Q2 results. Its adjusted EPS declined 21.3% year over year to $0.37. The company’s revenue totaled $50.2 billion, representing a 5% year-over-year increase.

For the current fiscal year, ending in December, analysts expect F’s EPS to decline 37.5% to $1.15 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last three quarters.

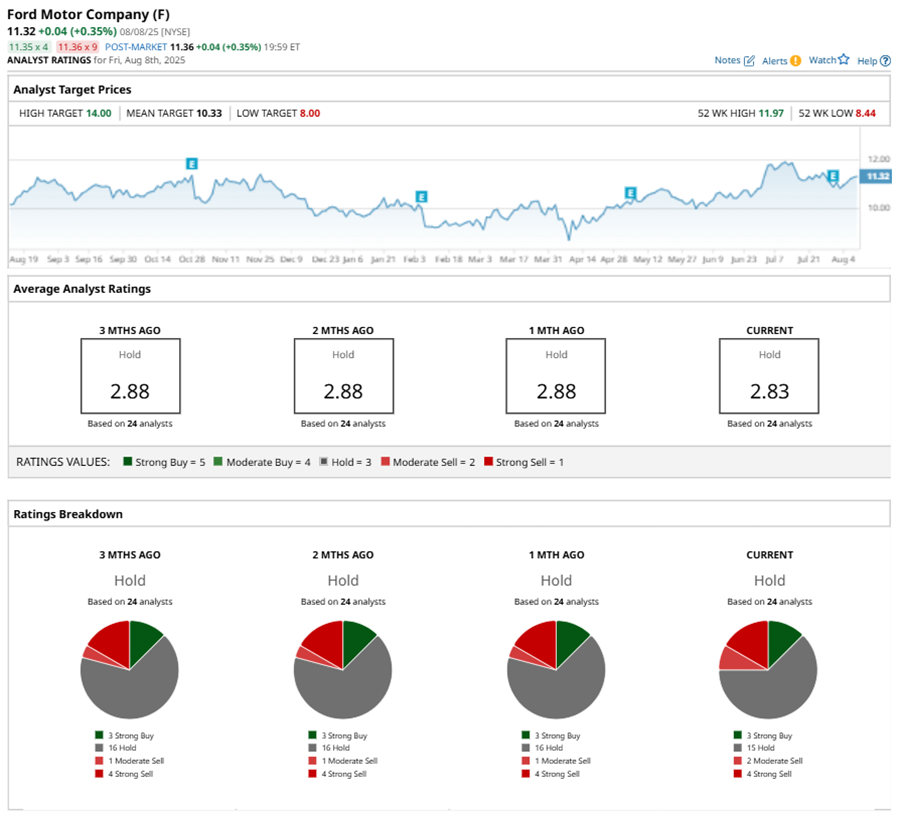

Among the 24 analysts covering F stock, the consensus is a “Hold.” That’s based on three “Strong Buy” ratings, 15 “Holds,” two “Moderate Sells,” and four “Strong Sells.”

This configuration is less bearish than a month ago, with one analyst suggesting a “Moderate Sell.”

On Aug. 4, RBC Capital kept a “Sector Perform” rating on F and raised the price target to $11.

While F currently trades above its mean price target of $10.33, the Street-high price target of $14 suggests a 23.7% upside potential.