With a market cap of $494.3 billion, Exxon Mobil Corporation (XOM) is a global energy company engaged in the exploration, production, and sale of crude oil, natural gas, and petrochemical products. Operating through its Upstream, Energy Products, Chemical Products, and Specialty Products segments, the company also pursues lower-emission technologies such as carbon capture, hydrogen, and lithium development.

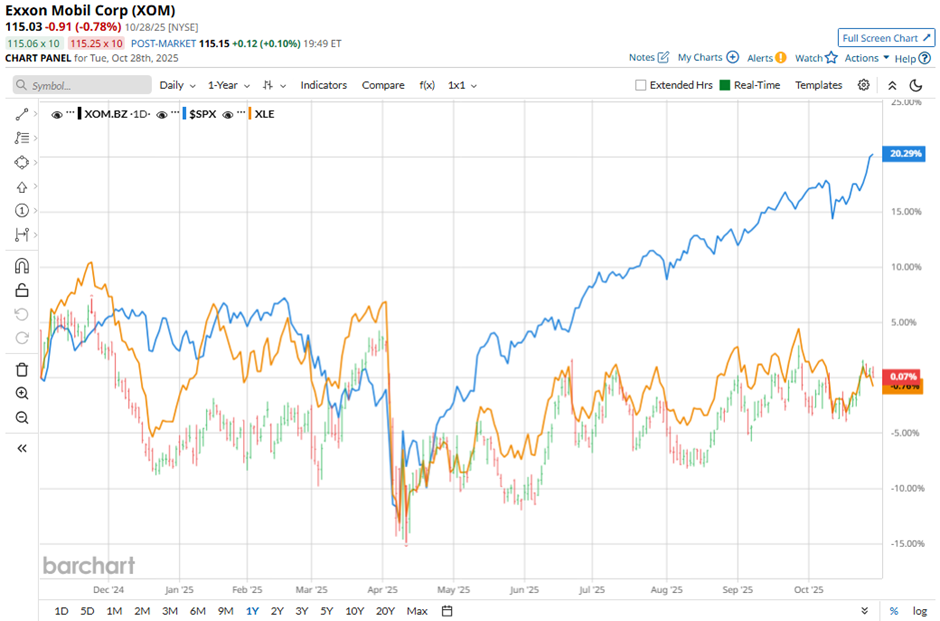

Shares of the Spring, Texas-based company have underperformed the broader market over the past 52 weeks. XOM stock has declined 3.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.3%. Moreover, shares of Exxon Mobil are up 6.9% on a YTD basis, compared to SPX's 17.2% gain.

Looking closer, the oil and natural gas company has also lagged behind the Energy Select Sector SPDR Fund's (XLE) 2.1% drop over the past 52 weeks.

Despite reporting better-than-expected Q2 2025 EPS of $1.64, shares of XOM fell 1.8% the next day as revenue of $81.5 billion came in below expectations, reflecting weaker oil prices. Earnings from oil and gas production fell to $5.4 billion, highlighting margin pressure despite record quarterly production of 4.6 million boepd.

For the fiscal year ending in December 2025, analysts expect XOM's EPS to dip 12.8% year-over-year to $6.79. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

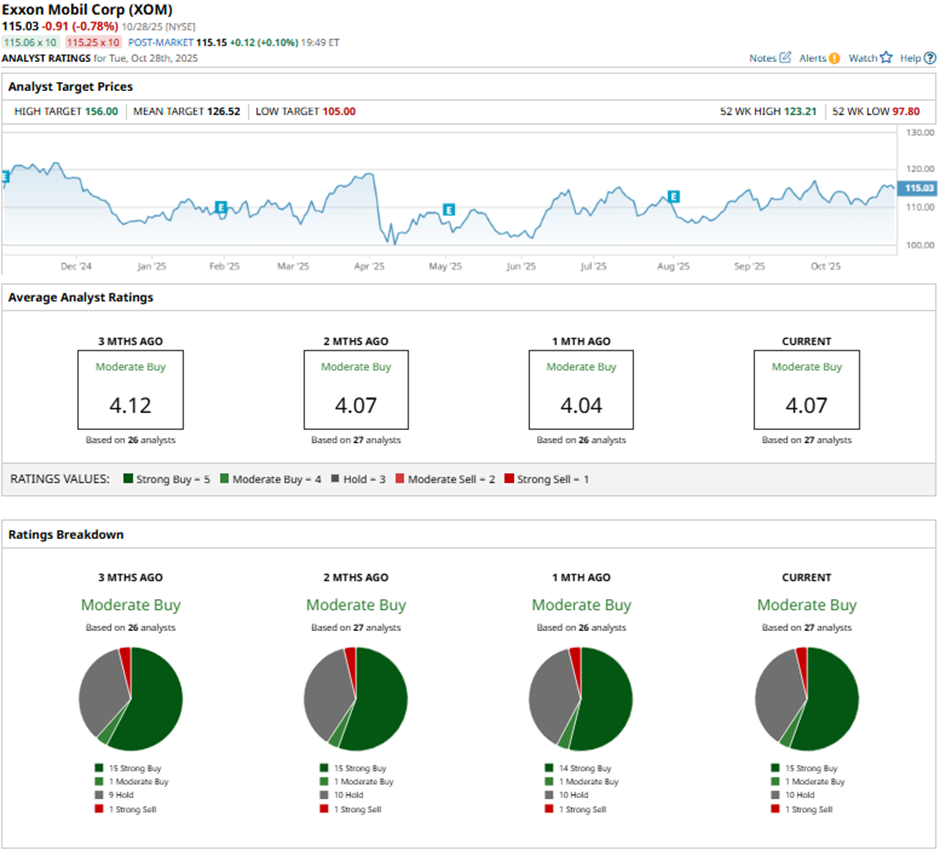

Among the 27 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 15 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and one “Strong Sell.”

On Oct. 9, Scotiabank raised Exxon Mobil’s price target to $128 with an “Outperform” rating.

The mean price target of $126.52, representing a premium of nearly 10% to XOM's current price. The Street-high price target of $156 suggests a 35.6% potential upside.