With a market cap of $39.8 billion, Entergy Corporation (ETR) is a leading integrated energy company engaged in electric power production and retail distribution. Serving over 3 million customers across Arkansas, Louisiana, Mississippi, and Texas, Entergy operates a diverse generation fleet of approximately 25,000 megawatts powered by gas, nuclear, coal, hydro, and solar sources.

Shares of the New Orleans, Louisiana-based company have outperformed the broader market over the past 52 weeks. ETR stock has surged 49.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16%. Moreover, shares of Entergy are up 16.1% on a YTD basis, compared to SPX's 9.6% gain.

Looking closer, the power company stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 14.8% return over the past 52 weeks.

Shares of Entergy rose 1.2% on Jul. 30 after the company posted stronger-than-expected Q2 2025 results, with net income of $1.05 per share and revenue of $3.3 billion. The utility also raised its long-term profit outlook, lifting its 2027 forecast to $4.70 per share - $5 per share and its 2028 forecast to $5.20 per share - $5.50 per share. Additionally, Entergy boosted its four-year capital expenditure plan to $40 billion to support 5 GW - 10 GW of new data center projects, including a potential deal to power Meta’s $10 billion Louisiana campus, and to expand solar, battery storage, and natural gas capacity.

For the fiscal year ending in December 2025, analysts expect ETR's EPS to grow 6.6% year-over-year to $3.89. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

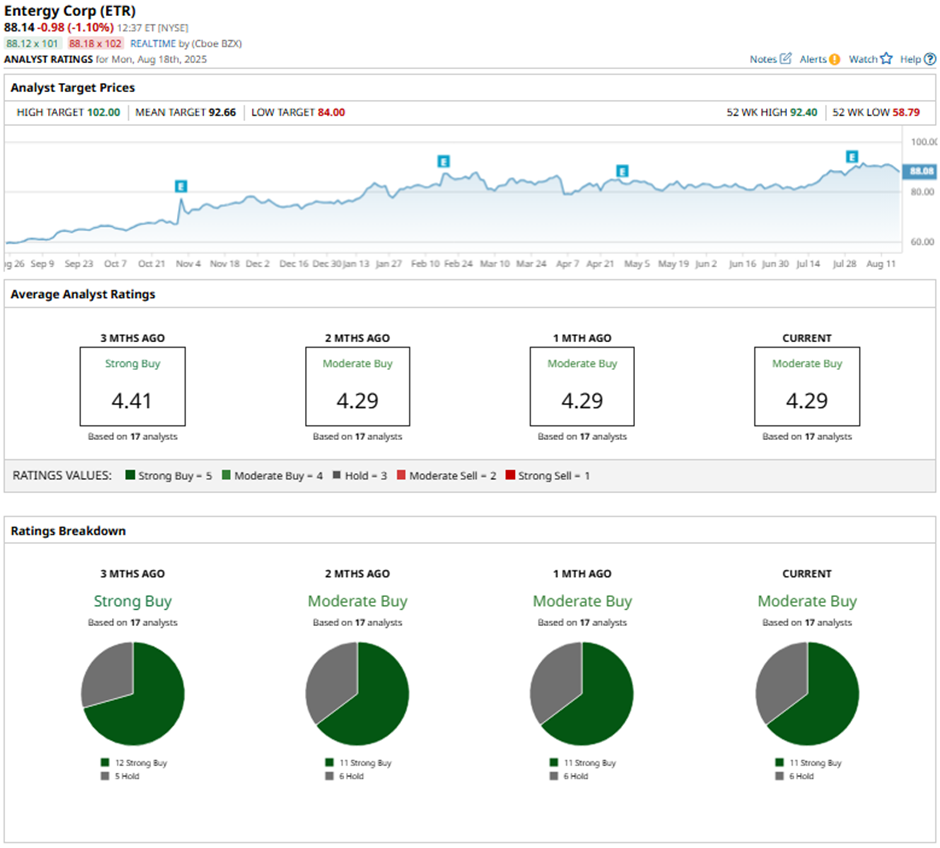

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings and six “Holds.”

This configuration is slightly less bullish than three months ago, with 12 “Strong Buy“ ratings on the stock.

On Jul. 31, Mizuho raised Entergy’s price target to $97 while maintaining an “Outperform“ rating.

As of writing, the stock is trading below the mean price target of $92.66. The Street-high price target of $102 implies a potential upside of 15.7%.