/Deckers%20Outdoor%20Corp_%20phone%20by-%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at a market cap of $12.1 billion, Deckers Outdoor Corporation (DECK) is a footwear and apparel company best known for its premium lifestyle and performance brands, including UGG, HOKA, Teva, Sanuk, and Koolaburra. The Goleta, California-based company serves its customers through wholesale partners, company-owned stores, and a robust e-commerce platform.

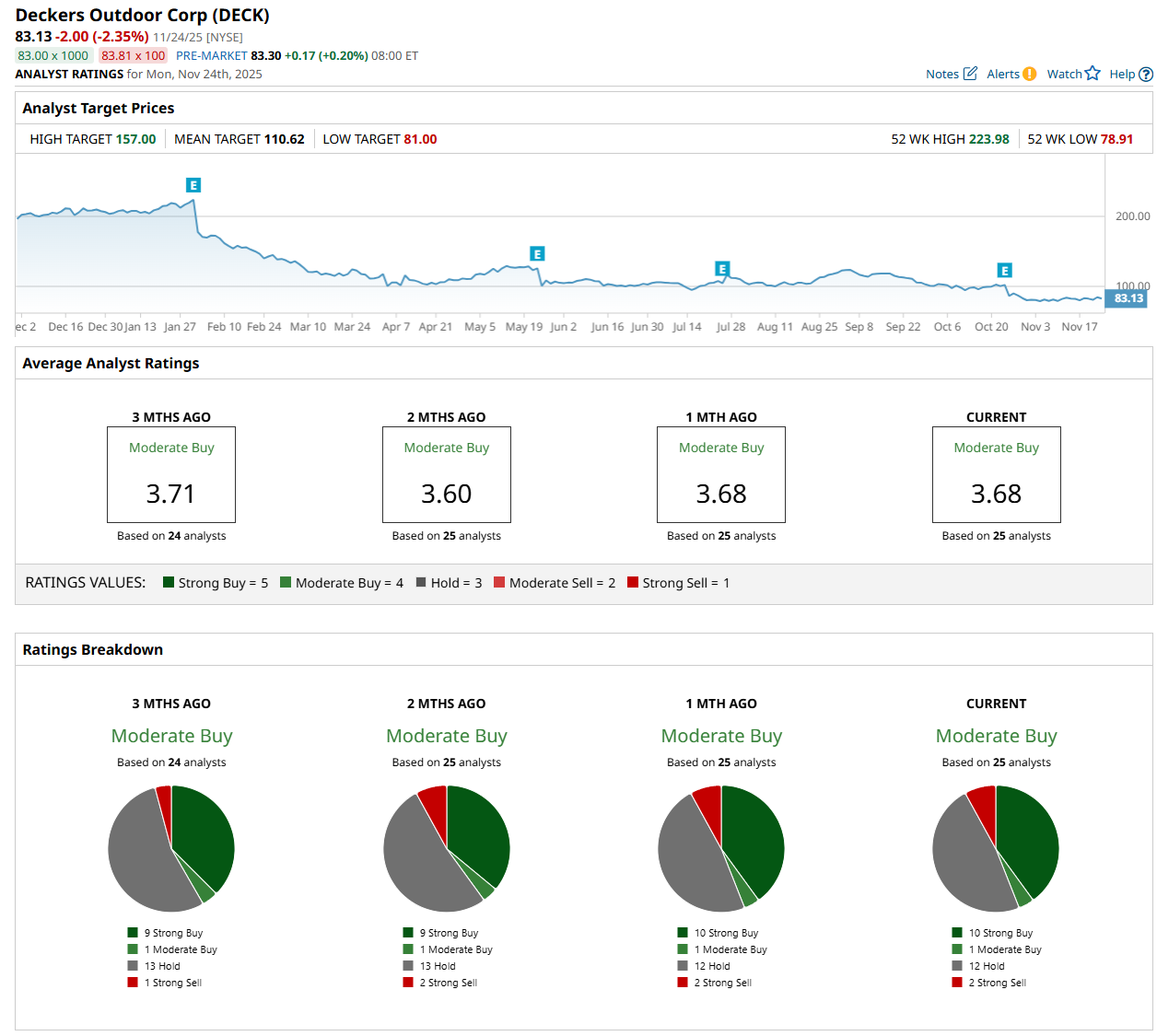

This footwear and apparel company has significantly lagged behind the broader market over the past 52 weeks. Shares of DECK have declined 56.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11%. Moreover, on a YTD basis, the stock is down 59.1%, compared to SPX’s 14% uptick

Narrowing the focus, DECK has also notably trailed behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 4.8% return over the past 52 weeks and 1.9% YTD rise.

DECK delivered better-than-expected Q2 earnings results on Oct. 23, yet its shares crashed 15.2% in the following trading session. The company’s revenue increased 9.1% year-over-year to $1.4 billion, while its EPS of $1.82 grew 14.5% from the year-ago quarter, handily surpassing consensus estimates. However, its fiscal 2026 revenue guidance of $5.35 billion at the midpoint came in below analysts’ estimates, which might have made investors jittery.

For the current fiscal year, ending in March 2026, analysts expect DECK’s EPS to grow 1.3% year over year to $6.41. The company’s earnings surprise history is promising. It exceeded the consensus estimates in each of the last four quarters.

Among the 25 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 10 “Strong Buy,” one "Moderate Buy,” 12 "Hold,” and two "Strong Sell” ratings.

This configuration is more bullish than two months ago, with nine analysts suggesting a “Strong Buy” rating.

On Nov. 18, Stifel Financial Corp. (SF) upgraded DECK to “Buy,” with a price target of $117, indicating a 40.7% potential upside from the correct levels.

The mean price target of $110.62 represents a 33.1% premium from DECK’s current price levels, while the Street-high price target of $157 suggests an ambitious 88.9% potential upside from the current levels.