CenterPoint Energy, Inc. (CNP), headquartered in Houston, Texas, engages in the business of power generation and distribution. Valued at $23.7 billion by market cap, the company conducts activities in electricity transmission and distribution, natural gas distribution, interstate pipeline and gathering operations, and power generation.

Shares of this leading electricity and natural gas provider have outperformed the broader market over the past year. CNP has gained 49.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 21.1%. In 2025, CNP stock is up 21.7%, surpassing SPX’s 7.9% gains on a YTD basis.

Zooming in further, CNP’s outperformance is also apparent compared to the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained about 16.8% over the past year. Moreover, CNP’s returns on a YTD basis outshine the ETF’s 13.1% gains over the same time frame.

On Jul. 24, CNP shares closed up by 1.9% after reporting its Q2 results. Its adjusted EPS of $0.29 lagged the consensus estimate by 14.7%. The company’s revenues were $1.9 billion, beating the consensus estimate by a whisker.

For the current fiscal year, ended in December, analysts expect CNP’s EPS to grow 8% to $1.75 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimates in three of the last four quarters while meeting the forecast on another occasion.

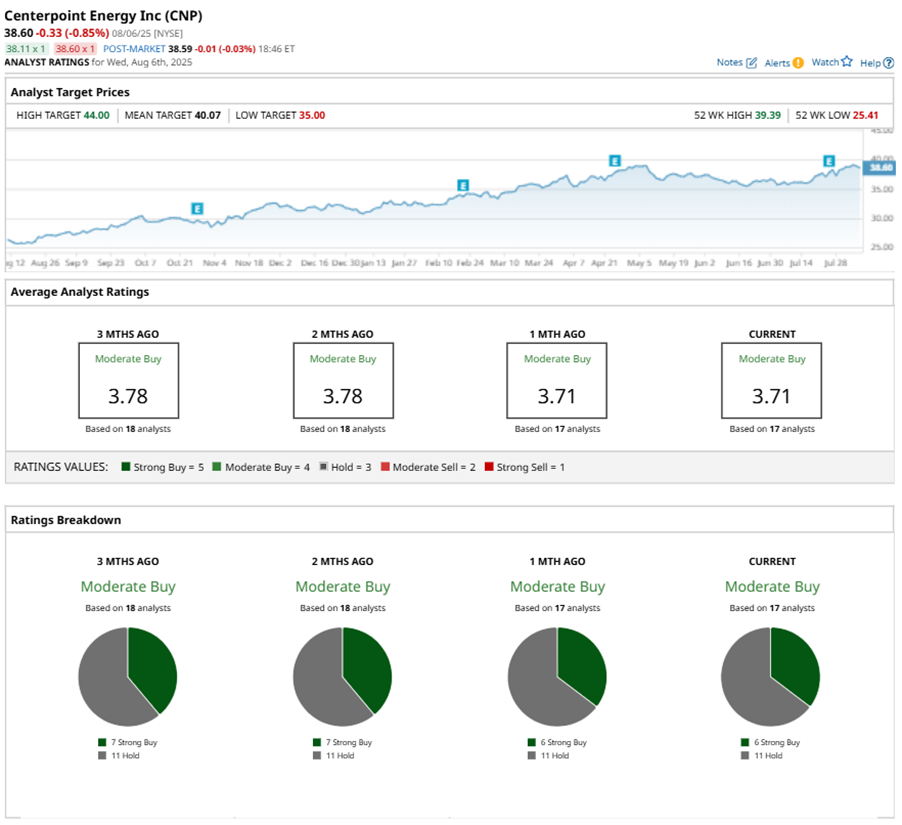

Among the 17 analysts covering CNP stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, and 11 “Holds.”

This configuration is less bullish than two months ago, with seven analysts suggesting a “Strong Buy.”

On Jul. 29, Barclays PLC (BCS) analyst Nicholas Campanella kept an “Equal Weight” rating on CNP and raised the price target to $39, implying a potential upside of 1% from current levels.

The mean price target of $40.07 represents a 3.8% premium to CNP’s current price levels. The Street-high price target of $44 suggests an upside potential of 14%.