/Autozone%20Inc_%20%20logo%20and%20chart%20by-%20IgorGolovniov%20via%20Shutterstock.jpg)

AutoZone, Inc. (AZO) is the premier retailer and distributor of aftermarket automotive parts and accessories, commanding a market capitalization of around $70.2 billion. Memphis-based AutoZone has evolved into a leading player in its sector, redefining automotive parts retail through widespread physical presence and robust distribution capabilities.

Despite macroeconomic headwinds, AutoZone stock has surged 31.1% year-to-date (YTD), almost mirroring its 52-week gain of around 31.3%. The stock has significantly outperformed the broader S&P 500 Index’s ($SPX) gain of 10.6% YTD and 16.3% over the past year.

Zooming in further, the stock has also outpaced the SPDR S&P Retail ETF (XRT), which has delivered 7.2% returns this year and 11.4% over the past year.

AutoZone’s strong share performance in 2025 reflects a compelling mix of shifts in consumer demand and smart strategy. With tariffs driving up new-car prices, more drivers are opting to repair older vehicles rather than replace them, boosting aftermarket parts demand for retailers like AutoZone.

For the current fiscal year, ending in August 2025, analysts expect AutoZone to report a marginal EPS growth to $147.23 on a diluted basis. The company has a weak earnings surprise history. It has missed the Street’s bottom-line estimates in the past four quarters.

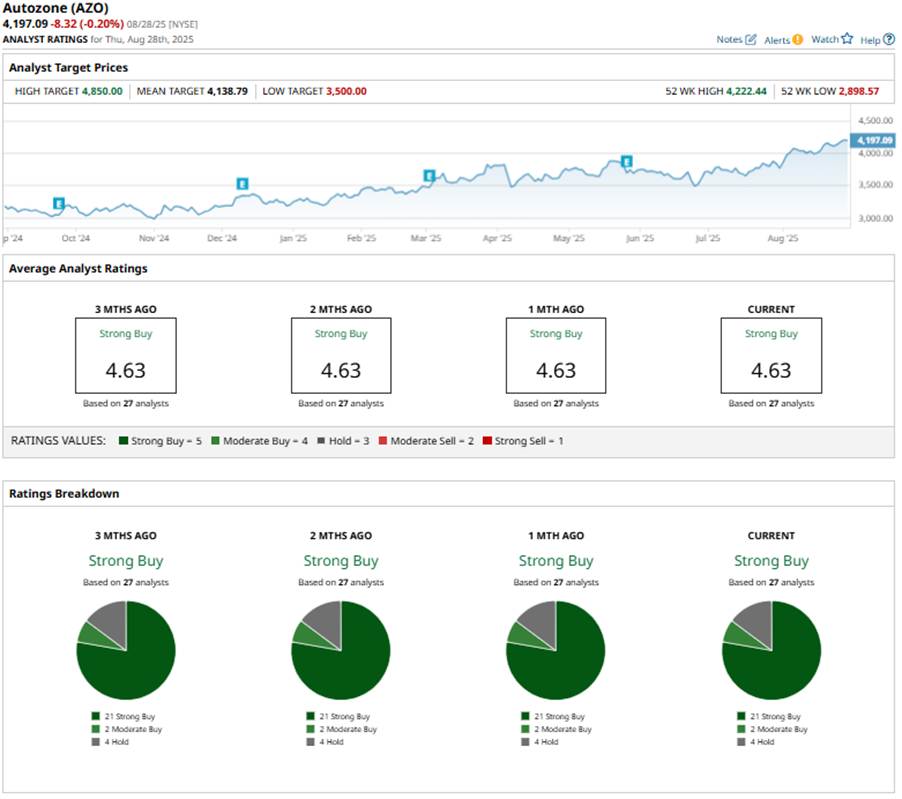

Overall, Wall Street appears bullish about AZO stock, with a consensus “Strong Buy” rating. Of the 27 analysts offering recommendations, 21 advise a “Strong Buy,” two has a “Moderate Buy,” and the remaining four have a “Hold” rating.

The current configuration has remained consistent over the past few months.

On Aug. 18, Evercore ISI analyst Greg Melich reaffirmed his “Outperform” rating on AutoZone and boosted his price target from $4,060 to $4,250, reflecting increased confidence in the company’s growth trajectory and resilient market positioning.

AutoZone’s rally has already pushed the stock past its average analyst target of $4,138.79, yet there’s still room to run. The Street-high target of $4,850 suggests that AZO stock has a 15.6% upside potential if bullish predictions play out.