Dallas, Texas-based Atmos Energy Corporation (ATO) is one of the largest fully regulated natural-gas utilities in the U.S., serving more than three million customers across states such as Texas, Colorado, Kansas, and Tennessee. With a market cap of $28.1 billion, the company focuses on safe, reliable gas distribution and invests heavily in pipeline modernization and infrastructure upgrades.

Shares of this natural gas distributor have outperformed the broader market over the past year. ATO has gained 18.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 12.3%. In 2025, ATO stock is up 24.9%, surpassing the SPX’s 12.9% rise on a YTD basis.

Zooming in further, ATO has surpassed the Utilities Select Sector SPDR Fund (XLU). The exchange-traded fund has gained 10% over the past year and 16.9% in 2025.

On Nov. 5, Atmos Energy reported FY2025 earnings, and its shares rose 1.9% in the next trading session. The company delivered a strong finish to the year, posting Q4 EPS of $1.07, ahead of estimates, and revenue of about $754.6 million, which also exceeded expectations.

For the current fiscal year, Atmos generated $1.2 billion in net income with EPS of $7.46, supported by roughly $3.6 billion in capital spending, most of which went toward system safety and reliability upgrades. Looking ahead, management issued upbeat FY2026 guidance, projecting EPS of $8.15–$8.35 and outlining a $4.2 billion capex plan, signaling confidence in continued regulated-growth momentum.

For the current fiscal year, ending in September 2026, analysts expect ATO’s EPS to grow 101.% to $8.21 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters, missing it once.

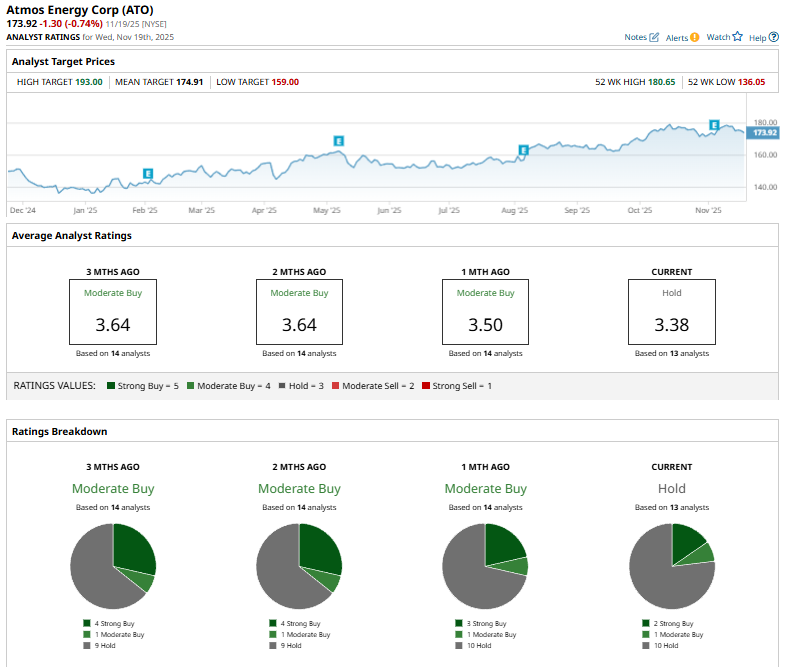

Among the 15 analysts covering ATO stock, the consensus is a “Hold.” That’s based on two “Strong Buy” ratings, one “Moderate Buy,” and ten “Holds.”

This configuration is bearish than a month ago, with three analysts suggesting a “Strong Buy.”

On Oct. 10, Barclays analyst Nicholas Campanella reiterated a “Hold” rating on Atmos Energy and set a $172 price target.

The mean price target of $174.91 implies a marginal premium to the prevailing market prices. The Street-high price target of $193 suggests an upside potential of 11%.