Bank failures aren’t as uncommon as you might think.

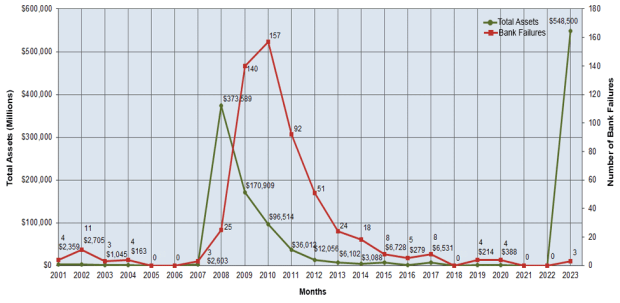

564 banks have collapsed since 2001, although the majority occurred during the Financial Crisis of 2007–2008 and resultant Great Recession, when 325 banks failed. 157 banks toppled in 2010 alone.

Back then, the culprit was toxic subprime mortgage debt, which affected nearly every aspect of American life. Millions of U.S. homeowners—many victims of unscrupulous predatory lending practices—did not understand the mechanisms behind their low-cost housing loans, and so when interest rates rose, they found themselves unable to make their monthly payments and defaulted as a result.

Banks had collateralized these mortgages into securities that could be easily traded, called collateralized mortgage obligations (CMOs). These debts were divided into tranches and categorized by risk level. Naturally, the riskiest tranches offered the juiciest yields. But as the underlying mortgages grew insolvent, the CMOs became worthless, unleashing a tidal wave of destruction throughout the entire financial system.

Mortgage lenders declared bankruptcy, and global investment banks like Lehman Brothers collapsed—even government-sponsored enterprises like Fannie Mae and Freddie Mac threatened to go under. In September 2008, the stock market crashed as the Dow Jones Industrial Average fell nearly 500 points, marking the beginning of an 18-month recession that was rivaled in magnitude only by the Great Depression.

Biggest Bank Failure of the Financial Crisis: Washington Mutual, Henderson, Nevada

Failure Date: September, 2008

Assets: $309 billion

Speaking of the Great Depression, the 1930s were an even more perilous time for banks: Nearly 9,000 banks failed, erasing $7 billion in depositor’s assets. Back then, there was no such thing as deposit insurance, which meant millions of Americans lost everything they had, forever.

Later, New Deal reforms such as the 1933 Banking Act—also known as the Glass-Steagall Act—exerted much-needed regulation over the country’s financial institutions and would lead to the formation of the Federal Deposit Insurance Corporation.

Biggest Bank Failure of the Great Depression: Bank of the United States, New York, New York

Failure Date: December, 1931

Assets: $200 million

In the 1980s, another form of high-yield debt, this time known as junk bonds, would spur on a banking crisis with community banks. The Savings & Loan Crisis stemmed from the implosion of these risky securities issued by companies who need to raise cash fast.

Smaller banks had invested heavily to shore up their own balance sheets stemming from losses accrued through the era’s extraordinary inflationary pressures. As interest rates skyrocketed, S&Ls simply could not generate enough capital from their depositors to offset their liabilities.

When the smoke cleared, 1,043 savings & loan associations had failed, amounting more than half of the country’s total. Michael Milken, considered the be a poster child for securities fraud, went to prison for 2 years and was ordered to pay a $600 million fine.

Biggest Bank Failure of the S&L Crisis: American Savings & Loan Association, Stockton, California

Failure Date: September 7, 1988

Assets $30.2 billion

Surprisingly, during the COVID-19 pandemic between November, 2020 and March, 2023, there was not a single bank failure in the United States. How could that be? While lawmakers point to that as evidence of the banking sector’s strength and proof of the viability of the “stress tests” put into place through reforms such as Dodd-Frank Act, which were passed in the aftermath of the Financial Crisis of 2007-2008, the Minneapolis Federal Reserve Bank believes otherwise.

“Banks avoided large losses from the COVID-19 financial shock because of the fiscal support the government provided,” First Vice President Ron J. Feldman and Senior Financial Economist Jason Schmidt concluded. They believed the resiliency of the banking sector was due to the helicopter money provided by the CARES Act and its stimulus checks, which enabled businesses to stay afloat and consumers to continue to pay their loans during the crisis.

What Are the Top 3 Biggest U.S. Bank Failures in History?

When a big bank fails, it isn’t pretty. Here are the largest to topple, in order of assets:

1. Washington Mutual (WaMu), Henderson, NV ($309 Billion Assets)

WaMu, the country’s largest savings & loan association, engaged in so much subprime lending, it grew to be known as the “Walmart of Banking” because it catered to the lower- and middle-class customers that other banks avoided. More than half of its assets were connected to the housing industry.

While other banks were leaving the subprime sphere as the Federal Reserve began to hike interest rates, WaMu only expanded further: Its high-risk loan originations grew from 19% of its total assets in 2003 to an astounding 55% just three years later in 2006.

This dicey move would lead to the bank’s undoing as it incurred record rates of defaults and credit downgrades on its securitizations. On September 25, 2008, frantic depositors sparked a bank run, withdrawing $16.7 billion in deposits. WaMu declared bankruptcy and was placed into receivership by the FDIC. It was eventually acquired by JPMorgan Chase.

2. First Republic Bank, San Francisco, CA ($229 Billion Assets)

Eleven of the country’s biggest banks pooled funds for First Republic Bank, but not even a $30 billion lifeline could save it. The beleaguered regional bank catered to tech startups, such as student loan app developers. It had a niche and wealthy clientele, many of whom kept large deposits on hand that exceeded the FDIC’s $250,000 insurance limit.

By the time the bank declared insolvency on May 1, 2023, its ratio of loans had exceeded its deposits. On the heels of the failures at Silicon Valley Bank and Signature Bank, two credit ratings agencies, Fitch and S&P Global, downgraded the bank in March 2023. Rattled and lacking confidence, First Republic’s customers withdrew more than $100 billion, nearly half its total assets.

First Republic was acquired by JPMorgan Chase on May 1, 2023.

3. Silicon Valley Bank, Santa Clara, CA ($209 Billion Assets)

The first bank to fall during the banking crisis of 2023, SVB counted Airbnb, Pinterest, and Cisco among its customers. During the COVID-19 pandemic, demand skyrocketed for the tech products it funded, and the company enjoyed a boom in its deposit base between 2019 and 2022—its assets tripled to $211 billion.

But things turned sour in 2023, when SVB announced a $1.8 billion quarterly loss and credit downgrade, suffering from interest-rate risk on its long-term reserves, which lost value when the Federal Reserve raised interest rates in 2022 and 2023. A bank run by SVB depositors resulted in a loss of $42 billion in a single day.

The bank was overtaken by the California Department of Financial Protection and Innovation and placed under receivership by the FDIC on March 10, 2023, and was later acquired by First Citizens Bank.