Canva

What Are Operating Expenses?

Operating expenses are costs tied to the normal operations of a company. They include the day-to-day expenses of a company’s business activities, but exclude those involved in the production of goods and services. They are also referred to as indirect costs, because operating expenses aren’t directly related to the costs of production as cost of goods sold is.

Operating expenses include costs for office rentals, warehouses, and payroll, and are recorded in the income statement. For publicly traded companies, the income statement is part of the financial statement that is filed quarterly and annually with the Securities and Exchange Commission.

Operating expenses are often shortened as “opex” (in the same way that capital expenditures is “capex”). These costs are used in calculating operating income.

How to Calculate Operating Expenses

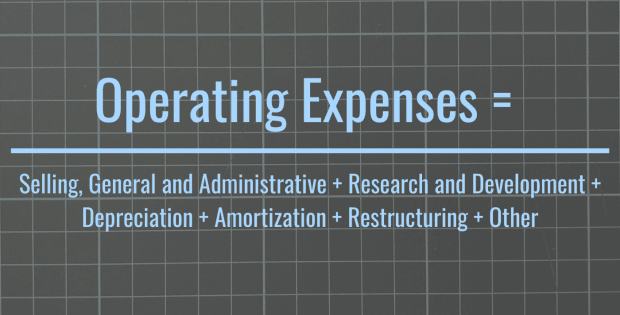

Operating Expenses Formula

Operating Expenses = Selling, General and Administrative + Research and Development + Depreciation + Amortization + Restructuring + Other

What Costs Are Included in a Company’s Operating Expenses?

There are various components in operating expenses, and each company has its own set of standards, but the line items below are what generally appears on the income statement. While costs for selling, general, and administrative may be a standardized item for many companies, some may not list depreciation and amortization because those expenses may be small.

Selling, General, and Administrative

Selling expenses are tied with selling, marketing, and distributing a product or service. Selling itself includes costs for commissions, while marketing costs include advertising, promotion via social media, and maintaining a website. Distribution costs include storage, inventory management, packaging, and shipping.

General expenses vary from covering rent on leased office space and utilities to office supplies and computer equipment. Administrative expenses cover wages, salaries, and benefits such as insurance and health care to non-sales employees. Other SGA expenses include legal fees, accounting fees, and travel.

Research and Development

Research and development expenses are tied to the costs of developing a company’s product or service.

Depreciation and Amortization

Depreciation and amortization can be bundled together, and their costs are related to the devaluation of the company’s tangible assets, such as machinery, office equipment, furniture, and buildings, and intangible assets including copyrights, trademarks, and patents.

Restructuring

Restructuring costs are tied with the reorganization of a company. It can involve costs associated with shuttering a business unit, demolishing a factory, or paying severance to salaried employees.

Other Costs

These costs cover expenses that aren’t recurring for every reporting period. Fees paid to consultants are an example.

Operating Expenses Example: Tesla (NASDAQ: TSLA)

In the table below—a partial listing of Tesla’s income statement—selling, general and administrative costs were the bulk of its operating expenses, followed by research and development. There were no known depreciation and amortization expenses listed.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about operating expenses.

Are Operating Expenses Fixed Costs?

Many expenses, such as those for rent, utilities, and salaries are fixed costs because they don’t tend to change every accounting period. But other items, such as selling expenses, for example, can be considered semi-variable costs because their costs are dependent on the volume of sales. Higher sales can lead to higher commission fees for some employees, while lower sales can translate to lower fees.

Can Operating Expenses Be Negative?

Operating expenses aren’t likely to be negative because they are costs charged to a company. A negative expense would mean a charge back to the company.

Are Operating Expenses the Same as Cost of Goods Sold?

Operating expenses are indirect costs tied to the day-to-day operations of a company, while cost of goods sold are direct costs tied to the production of a company’s goods or services.

What Is the Difference Between Operating Expense and Capital Expenditure?

Capital expenditures are costs tied to the purchase of a company’s assets, including property, plants, and machinery, and are not considered part of daily operating expenses because they tend to be one-time costs. For example, plants and machinery can be idled for months at a time until they become necessary to operate, compared to a manager who is typically working year-round to help a company operate efficiently.

Why Aren’t Interest Expenses and Tax Payments Part of Operating Expenses?

Interest expenses and tax payments are not part of operating expenses because payment on debt and taxes do not count as part of a company’s daily operations.