What Are Jobless Claims and Why Do They Matter?

Jobless claims refer to the number of individuals that filed for unemployment benefits during a given week. Every Friday at 8:30 am Eastern, the Department of Labor releases its jobless claims statistic for the previous week.

This report is eagerly awaited by economic analysts and investors, as jobless claims are an important leading indicator of the U.S. economy, and a noticeable rise or fall in the number of claims has the potential to stir up volatility in the securities market. When jobless claims rise, especially in concurrence with other factors like high inflation or supply-chain slowdowns, pundits worry that the economy could be in trouble.

It’s important to note that jobless claims do not necessarily reflect the number of people receiving unemployment benefits, as not everyone who applies for these benefits is approved.

What Are the 2 Types of Jobless Claims?

Jobless claims are divided into two categories—initial and continuing. Together, the two categories represent the total number of individuals that filed for unemployment benefits during a given week.

Initial

Initial jobless claims include only first-time filers. These are individuals who filed for unemployment benefits during the week in question but did not file the week prior. Presumably, those in this group have just become unemployed.

Continuing (Insured Unemployment)

Continuing claims include only those who have already received unemployment benefits for one or more weeks and are continuing to apply for them, presumably since they have yet to secure new employment. Continuing claims (also called insured unemployment) tend to be significantly higher than initial claims.

Jobless Claims Example: The 2020 COVID-19 Pandemic

In early 2020, the onset of the global COVID-19 pandemic led to a cascade of business closures and work stoppages in the United States and across the globe. Businesses furloughed and laid off record numbers of workers, and as a result, jobless claims skyrocketed to record highs.

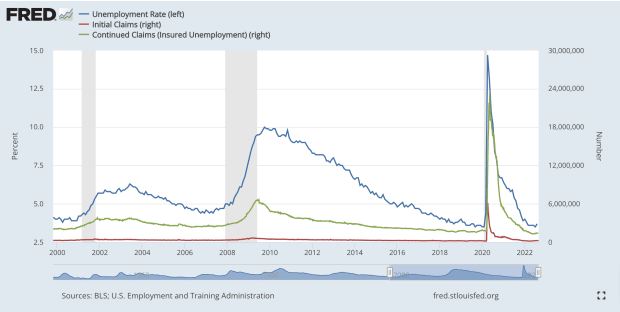

This phenomenon can be observed in the graph below from FRED, in which both the red (initial claims) and green (continued claim) lines peak during the first half of 2020, during the short-lived recession spurred by the viral outbreak.

As a result of industry-wide shifts toward remote work, the development of vaccines, and companies pushing to get back to business, jobless claims quickly fell back toward their old norms.

How Do Jobless Claims Affect the Stock Market?

Jobless claims may or may not have a significant impact on the stock market each Friday. When they do, it is typically because numbers are higher or lower than expected.

If jobless claims are unexpectedly high, economic pessimism can sometimes spur a selloff in equities (especially riskier ones), causing the stock market to close lower. If jobless claims are unexpectedly low, on the other hand, the resulting economic optimism could prompt confidence in stocks, causing the market to close higher.

How Do Jobless Claims Relate to Recession?

During recessions, companies often have less revenue and choose to cut costs, sometimes by laying off workers and slowing down hiring. Workers who have been laid off must then file for unemployment, and workers who are already unemployed may have an even harder time finding a job. For this reason, both initial and continuing claims tend to rise during periods of recession.

This trend can be seen in the graph above, where the shaded gray areas represent periods of recession, and the red and green lines represent initial and continuing claims, respectively.

How Do Jobless Claims Relate to the Unemployment Rate?

Jobless claims are highly correlated to the unemployment rate—in other words, the two tend to move up and down in lockstep—despite the fact that jobless claims are considered a leading indicator while the unemployment rate is considered a lagging indicator.