In 2018, when WeWork was raising money at a $20 billion valuation, the thinking was: "Office occupants are realizing they kind of like being around people and they don’t mind having less space."

WeWork's value proposition was simple: It was amazing at optimizing space, and was able to squeeze the number of square feet per worker down to a borderline-claustrophobic 75.

- The 75 square feet includes all the seemingly spacious communal areas, which means the actual offices are even more tightly packed.

Driving the news: WeWork is desperately trying to renegotiate its leases, while its controlling shareholder, SoftBank, is reneging on its promise to spend $3 billion buying back shares from ousted founding CEO Adam Neumann and others.

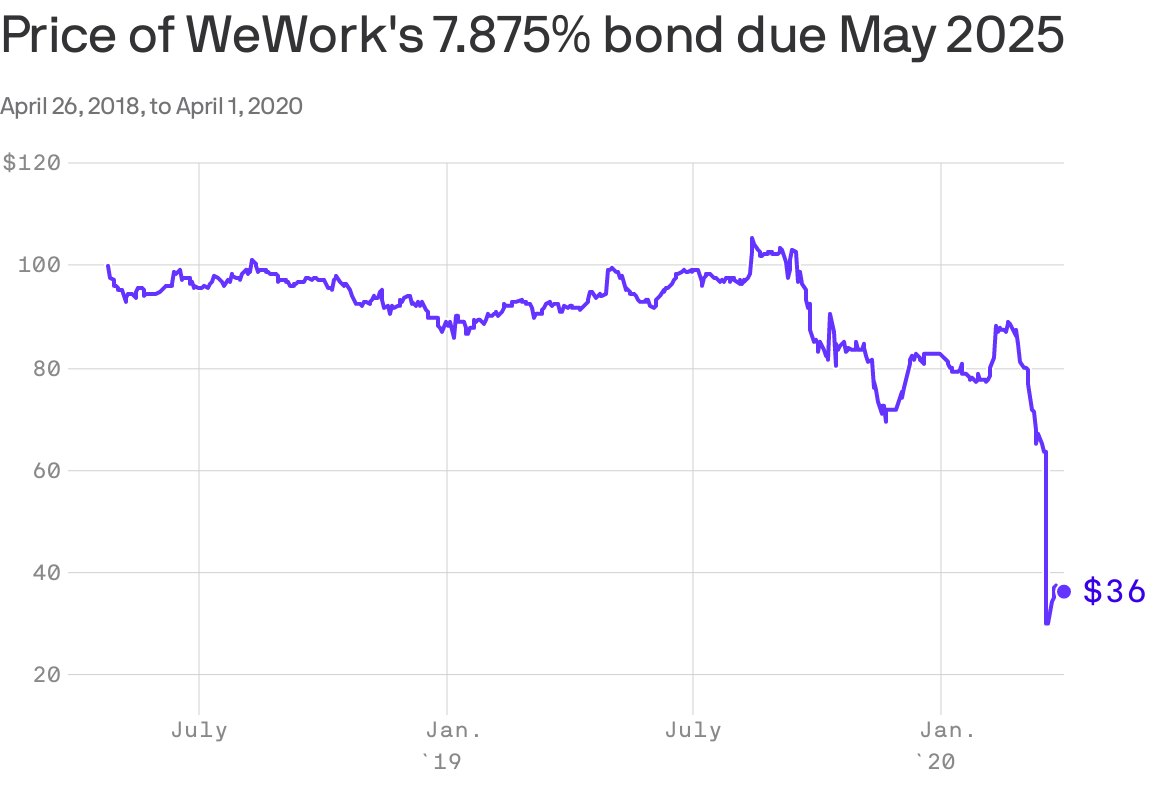

Why it matters: The bond market is sending a strong signal that the true value of WeWork's equity is exactly $0. The company's bonds are trading at severely distressed levels, meaning that after default and bankruptcy, there's likely to be very little value in the company for bondholders to be able to recover.