/West%20Pharmaceutical%20Services%2C%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $17.6 billion, West Pharmaceutical Services, Inc. (WST) is a global leader in innovative containment and delivery systems for injectable drugs and healthcare products. Operating through its Proprietary Products and Contract-Manufactured Products segments, the company serves pharmaceutical, biologic, and medical device customers worldwide.

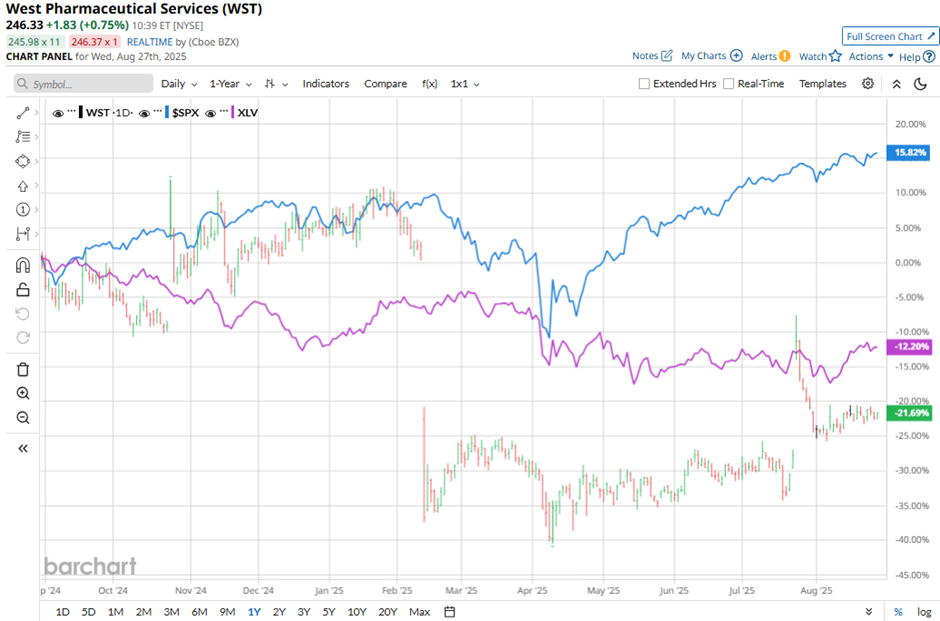

Shares of the Exton, Pennsylvania-based company have underperformed the broader market over the past 52 weeks. WST stock has decreased 18.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained nearly 15%. Moreover, shares of the company have declined 24.7% on a YTD basis, compared to SPX's nearly 10% rise.

Looking closer, West Pharmaceutical stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 11.6% drop over the past 52 weeks.

Shares of West Pharmaceutical climbed 22.8% on Jul. 24 after the company reported Q2 2025 adjusted EPS of $1.84, well above analyst expectations. Revenue rose 9.2% year-over-year to $766.5 million, surpassing the Street’s estimate. Investor optimism was further fueled by the company raising its 2025 profit outlook to $6.65 per share - $6.85 per share and lifting its annual sales forecast to $3.04 billion - $3.06 billion, while trimming expected tariff impacts to $15 million - $20 million.

For the fiscal year ending in December 2025, analysts expect WST's adjusted EPS to dip marginally year-over-year to $6.74. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

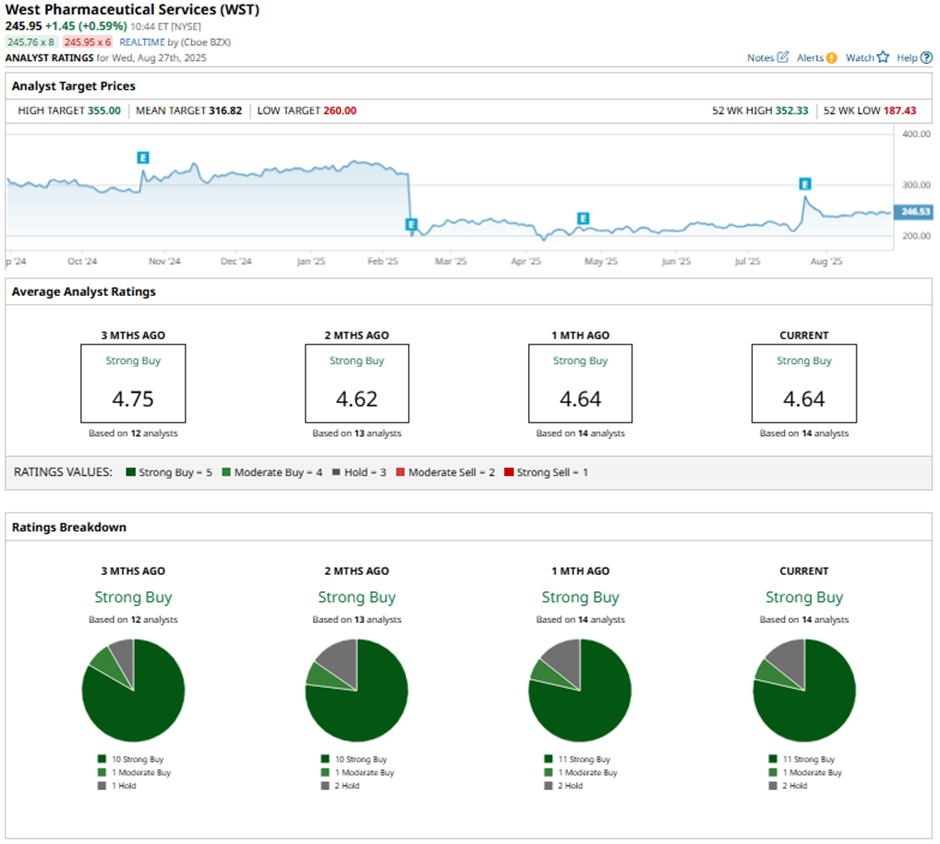

Among the 14 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” and two “Holds.”

This configuration is slightly more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 8, Bank of America Securities analyst Michael Ryskin reaffirmed a “Buy” rating on West Pharmaceutical Services with a $310 price target.

The mean price target of $316.82 represents a 28.8% premium to WST’s current price levels. The Street-high price target of $355 suggests a 44.3% potential upside.