Toledo, Ohio-based Welltower Inc. (WELL) operates as a REIT and engages in investments with seniors housing operators, post-acute providers, and health systems. With a market cap of $142.9 billion, Welltower’s portfolio is concentrated in major, high-growth markets in the U.S., Canada, and the U.K.

Companies worth $10 billion or more are generally referred to as “large-cap stocks.” Welltower fits right into that category, with its market cap exceeding the threshold, reflecting its substantial size, influence, and dominance in the real estate sector.

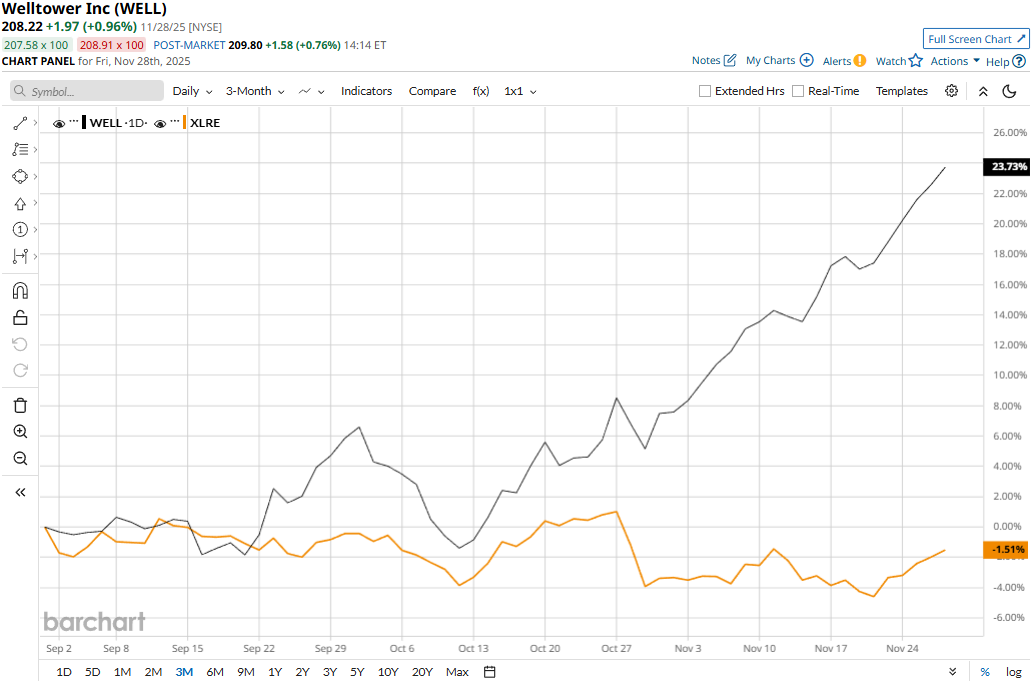

WELL stock touched its all-time high of $209.05 on Nov. 28 and is currently trading marginally below that peak. Meanwhile, WELL stock prices have soared 24.4% over the past three months, outperforming the Real Estate Select Sector SPDR Fund’s (XLRE) 97 bps dip during the same time frame.

Welltower’s performance has remained impressive over the longer term as well. WELL stock prices have soared 65.2% on a YTD basis and 49.5% over the past 52 weeks, compared to XLRE’s 2.5% uptick in 2025 and 7.8% decline during the same time frame.

Welltower stock has traded consistently above its 200-day moving average over the past year and mostly above its 50-day moving average since January, with some fluctuations, underscoring its bullish trend.

Despite reporting better-than-expected results, Welltower’s stock prices dropped 1.6% in the trading session following the release of its Q3 results on Oct. 27. Continuing its momentum, the company reported a solid 36.4% year-over-year surge in residential fees and services revenues. Further, it also delivered a solid surge in rental income, leading to a 30.6% surge in total revenues to $2.7 billion, surpassing the Street’s expectations by 1.4%. Meanwhile, it delivered a massive 20.7% surge in normalized FFO per share to $1.34, beating the consensus estimates by 3.1%.

However, Welltower stock had observed a notable rally before its earnings release, and the results probably didn’t impress investors.

Nonetheless, Welltower has significantly outperformed its peer Ventas, Inc.’s (VTR) 36.9% surge in 2025 and 24.9% gains over the past year.

Among the 20 analysts covering the WELL stock, the consensus rating is a “Strong Buy.” As of writing, WELL stock is trading above its mean price target of $203.79.